|

Analysis of Derivative Contracts in Trading

Business

To fully understand this analysis, you will

need to read Analysis of Exchange Trading, Sections 1

and 2 first.

Derivative financial trades are gaming an increasingly prominent role in

trading. A derivative trade is one whose value depends on another security's

value. The simpler forms of derivatives have been around for quite a while; for

example, stock options were first traded on an organized exchange in 1973.

Since then, more and more exotic variants of derivatives have appeared. They are

valuable to investors because they reduce the risk that comes from changing

prices. However, when they are not properly controlled, derivatives can be

dangerous: Recently, in several famous cases, organizations have lost

spectacular

amounts of money on ill-managed derivatives.

Modeling derivatives brings out many useful aspects of modeling because

derivatives form a natural generalization hierarchy - one that is more

interesting

than the usual examples of plants and animals. The purpose of this analysis,

therefore, is to explore some of the problems of this kind of generalization

hierarchy

using derivatives as examples.

We begin by introducing the simple derivatives: Forward Contracts

(Section 1) and Options (Section 2).

Forward contracts introduce the notion of tenor, which leads to a discussion of

why date calculations are more complicated than adding up days.

Options present a couple of awkward modeling areas: handling the trader's

definitions of calls and puts, and the relationship between an option and

the underlying contract.

A more complex type of derivative, the combination option, can be seen as an

aggregation of simpler options. Sub-typing from options with the composite

pattern is not always effective; this leads to the Product

(Section 3) pattern. This pattern is based on the difference between the

seller's and trader's views

of the deal and can be applied to regular trading as well. It also serves as an

example of how generalization is often the first method we think of using but is

not necessarily the best.

With sub-typing we must ensure that the sub-type's behavior is consistent with

that of the super-type. Using barrier options as an example, we will explore

how sub-typing and state charts interact with Sub-type State

Machines (Section 4).

If we have a portfolio of options, we can choose to have a browser that

highlights pertinent details, depending on the kind of option. This leads to a

situation where there are parallel application and Domain Hierarchies

(Section 5). The two hierarchies are awkwardly coupled.

This pattern poses a problem with several solutions, none of which is

all-powerful.

Key Concepts: Forward Contract, Tenor, Option, Product

1. Forward Contracts

The contracts discussed in

Analysis of Exchange Trading,

Section 1 are simple and involved in immediate deals. Most markets involve a

range of more complex deals.

The simplest of these is the forward contract. With a normal contract, often

referred to as a spot contract, delivery occurs as close as possible to the date

on which the contract is traded. Delivery usually occurs in a couple of days.

Forward contracts are agreements to do a deal some time in the future.

For example, a company is due to receive a tanker full of oil in two months. The

company will have to pay several million dollars for this oil.

However, if the company is German, its normal financing is done in marks. If the

dollar/mark exchange rate changes significantly in the next two months,

the company could find itself having to pay more marks than it expected, which

could be a significant problem. Of course, the company would also gain from

a favorable change in exchange rates; but the uncertainty is not good for the

company. To allay this uncertainty, the company could choose to buy several

million dollars in a forward contract exchange rate deal, paying an agreed

amount of marks now for delivery of dollars in two months.

The price is offered by the bank who is carrying out the deal based on the

market's perception of where the dollar/ mark rate is likely to go in the next

couple of months. Such a deal is said to have a tenor of two months (as opposed

to a tenor of spot).

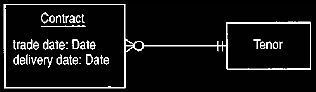

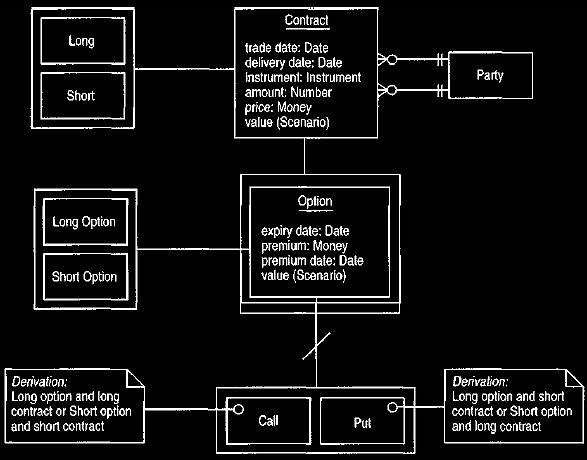

A forward contract is quite easily captured by holding separate trade and

delivery dates for the contract, as shown in Figure 1. A spot deal will

have

suitably close trade and delivery dates, while a forward contract deal will have

these dates separated by two months. A sub-type is not needed to show this,

although we can add one for clarity.

Figure 1. A contract that can support forward contracts.

The tenor is based on the difference between trade and delivery dates.

Example: Aroma Coffee Makers agrees on January 1, 2007 to buy 5000 tons

of Bra zilian coffee from Brazil Coffee Exports.

Delivery is set for October 20, 2007, and the price is set at today's price.

Example: we buy an airline ticket for travel in three months, paying the

price currently quoted for the journey.

An important consideration when discussing forward contracts is the tenor of the

contract. The tenor is the period between the trade date and the delivery

date, in our example two months. Prices are generally quoted on the market with

a particular tenor in mind, and the tenor is an important part of the

contract's consideration. However, the tenor is not simply the duration between

trade and delivery dates. If our two-month contract is traded on May 4, the

delivery date will not be on July 4, simply because the 4th of July is a holiday

in the United States. Holidays have a big impact on how these dates are

calculated.

Assuming July 4 does not fall on a weekend, a two-month contract dealt on May 4

will take delivery on July 5. Note that if for some reason Germany had a

holiday on July 5, the delivery date would be shifted forward another day. The

contract still has a tenor of two months, even though its delivery date is the

same as a contract with a delivery date of two months and one day. Note that

this behavior is required for spot contracts as well: a deal done on a Thursday

will be delivered on a Monday (unless it is a holiday) even though spot is taken

as two days. Hence Figure 1 includes trade date, delivery date, and tenor.

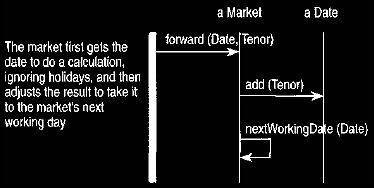

In this kind of structure, the calculation of the delivery date is not something

that can be done by the trade date and tenor alone. Without considering

holidays,

we can determine the delivery date by a simple calculation between date and

tenor. However, the market holidays have to be taken into account. This means

that the market has a date calculation routine that allows it to adjust for

holidays, as shown in Figure 2. This consideration of holidays is an

important feature

in many areas, where the concept of working days becomes important. It is

usually not possible to determine working days globally because holidays vary

from country to country, or possibly with even greater granularity. Individual

sites may also have local holiday conventions that will affect working day

calculations.

Figure 2. Getting the market to calculate dates.

Date calculations often need to be delegated to another object when working

days need to be calculated.

Example: A company needs to make a payment to an employee within five

working days from June 30,2007.

If it is a US company, this is by July 8 (skipping over weekends and July 4);

for a UK company it is July 7.

Modeling Principle: Date calculations are often affected by holidays,

which need to be skipped over.

Holidays vary from country to country and often by the organizations involved.

2. Options

For our German oil company, a forward contract is a valuable tool for reducing

the risk of an exchange rate change that would cause them to pay more for their

oil. But the company does run the risk of losing out should the exchange rate

change in their favor. Financial directors essentially have to bet on the

exchange

rate movement. If they think the mark will go up, they should buy on the spot

market; if they think it will go down, they should buy forward contracts.

Options reduce this risk. An option gives the buyer the right to buy dollars at

a prearranged exchange rate if the holder wishes. Thus, if the mark goes down,

the oil company can exercise its option and buy the dollars at the prearranged

price; if the dollar goes up they can ignore their option (let it expire) and

buy on

the spot market. The bank charges a premium to the oil company to sell them the

option, so the bank now manages the risk. Since the bank handles many

such deals, they can offset the risks of various deals against each other.

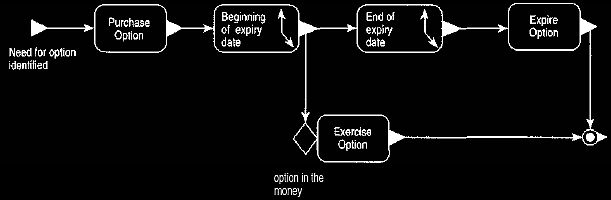

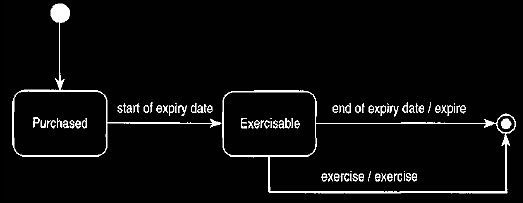

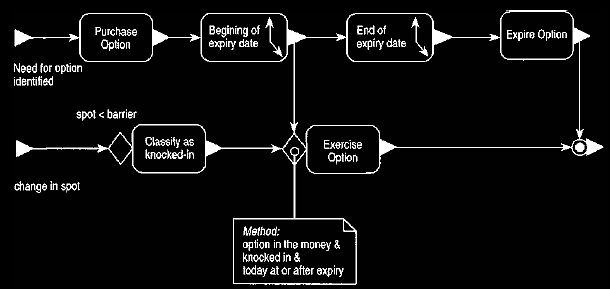

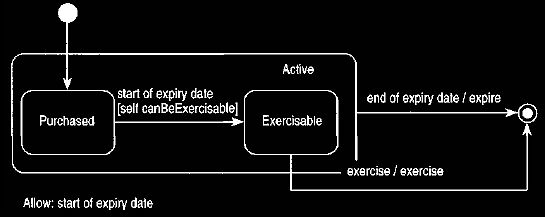

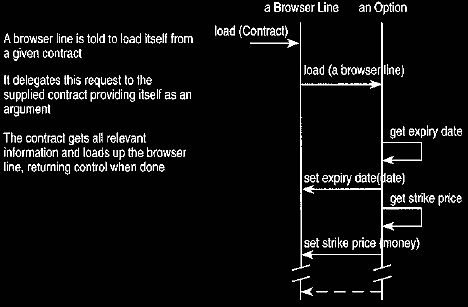

Figures 3 and 4 describe the behavior of an option.

Figure 3. Event diagram for the process of using an option.

An option can only be exercised after the start of the expiration date and

will only be exercised if it is "in the money," that is,

if exercising the option is a better deal than a spot trade at the current

price.

Figure 4. Harel state chart to illustrate how an option behaves.

The option can only be exercised on its expiration date (a "European"

option).

Many features of the option are similar to that of a normal contract. Like a

normal contract, options have counterparties and trade dates. Other features of

the option include the expiration date, the amount of premium, and date the

premium is delivered.

Thus we can consider an option to be a sub-type of a contract, as shown in Figure

5. A key feature of the option structure is the polymorphic operation

value (Scenario). The value of a spot contract is easy to understand because it

is simply the result of applying the spot exchange rate in the provided scenario

to the amount of the contract. Options are rather more complex to value, to put

it mildly. The most common technique is Black-Scholes analysis. An

explanation of this is beyond the scope of this book, except to point out that

as far as the caller of this operation is concerned, it is a single operation.

The complexities of the mathematics can safely be hidden within the operation.

Figure 5. Structure of an option.

Call and put are terms derived from the longs and shorts.

2.1 Longs, Shorts, Calls, and

Puts: Representing a Tricky Vocabulary

The question of longs and shorts does

need discussion. In

Analysis of Exchange Trading,

Section 1 we explained that a contract can be long (buy) or short (sell).

For options, however, we find that there are four possible choices. We can sell

an option to sell money, sell an option to buy money, buy an option to sell

money,

or buy an option to buy money. The long/short choice still exists on the

contract, but it is supplemented by a further long/short choice on the option.

The trader's vocabulary includes the terms call and put. A call is an option to

buy (that is, a long contract), while a put is an option to sell (a short

contract).

Naturally we can buy or sell a call, or buy or sell a put. Representing this

language is somewhat tricky, as well as confusing.

If we sell an option to buy yen, then the counterparty can buy yen from us at the

expiration date. The difference between this and a forward is that the

counterparty can choose not to. If we buy an option to sell yen, then the

position is the same, but the control over exercising the option is now mine.

Either way,

we are (potentially) short on yen, hence the contract is short. In the former the

option is also short, while in the latter the option is long. In the first case

traders

would say they are selling (short) a call, and in the second they would say they

are buying (long) a put.

One way of looking at this would be to say that we could replace the long/ short

description of a contract by call/put. But this does not really work because

we do not use the terms call and put on contracts that are not options.

Another possibility is to use the terms long and short for options only to

indicate the state of the option rather than the contract. Thus the first

example

above would be a short call and the second a long put. This might make sense to

a trader but would be apt to confuse any software. When evaluating risk, the

position of the amount of the contract is important, and in the above examples

both are short. Hence we need to be able to ask the direction of the contract

(which defines the position), the direction of the option, and the call/put. So

the two examples are (short contract, short option, call) and (short contract,

long

option, put). Clearly one of these can be derived from the other two. The

diagram indicates that call/put is derived. The derivation is a reminder that

one

is derived rather than any direction to an implementor of what is actually

stored or calculated in the implementation.

Representing language like this is always a bit of a battle, particularly when

it seems unnecessarily illogical. The important thing is to represent the

fundamentals in a logical manner. These fundamentals may be part of the domain

expert's terminology or invented during the modeling process (but if

they are invented, the domain expert must be comfortable with them). The rest of

the terminology can then be derived from these fundamentals.

Modeling Principle: Derived markers should be used to define terminology

that is derived from other constructs on the model.

Modeling Principle: Marking a feature as derived is a constraint on the

interface. It does not affect the underlying data structures.

Example: On June 1, 2007, we are given an option to buy 200 shares

of Aroma Coffee Makers on January 1,2009 at a price of $5 per share.

This is an option with a trade date of June 1, 2007, an instrument of Aroma

Coffee Makers stock, an amount of 200, delivery and expiration dates of January

1,2009,

a premium of $0, and a price of $5.1 will gain shares, so the contract is long

(with respect to us), and the option is also long (since we hold it); it is thus

a call.

Example: When we make a reservation for a flight, we are being

given a call option on the ticket.

The expiration date of the option is the date the reservation must be ticketed.

Another concern is the interaction between delivery date and expiration date.

For an option, the delivery date can be computed if the expiration date is known

(delivery date = expiration date + spot). The reverse is not true, however (due

to the interference of holidays). This means that, for options, delivery date is

a

computed mapping. The important point here is that the interface does not

change: There is still an accessor for delivery date; however, the information

is

stored. There are two alternatives to describe this situation: We can note

(typically in the glossary) that for options the delivery date attribute is

overridden and

calculated from the expiration date according to the formula. Another option is

to describe the formula as a constraint on the option type. Both are perfectly

reasonable and the choice is a matter of taste. It is entirely up to the

implementor what code and data structure to use.

2.2 To Sub-type or Not to Sub-type

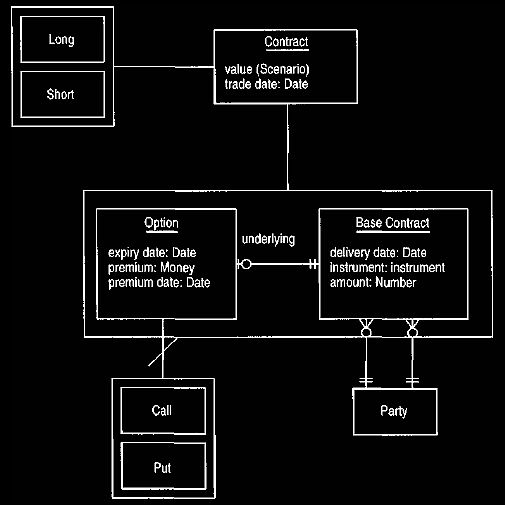

The structure shown in Figure 5 is not the only way to handle options;

another choice is shown in Figure 6. The difference between the two

structures

is how the optionality is added to the contract. In Figure 5 we add it by

sub-typing. In this scheme an option is a kind of contract with additional

properties and some variant behavior. In Figure 6 we may say that an

option has a base contract often referred to by traders as the underlying of the

option.

There is at least some notion of containment here, especially in the fact that

we would not be likely to ask the contract to value itself if it was an

underlying to

an option. Similarly the delivery date would be dependent on the option's

expiration date.

The choice between the two structures is not easy. Both have elegant qualities.

The Figure 6 model separates the notion of option and contract

with a definite notion of underlying. One disadvantage of this scheme is that a

single contract is represented by two objects. It is easier to alter Figure

6 to

handle compound options (options where the underlying is an option). With so

little choice between them, we can easily end up getting bogged down.

Prototyping can sometimes clarify the situation but not always. When

alternatives like this present themselves, it's a good idea to use the simpler

approach and then change to the more complicated one later if necessary. With

this case, however, it is arguable which is the simpler.

When it is this close, we trust the domain experts' instincts by asking them

which feels best. We will continue to use Figure 5 as the basis for

further discussion.

Modeling Principle: When faced with alternative approaches, choose the

simplest first and change to a more complex one as needed.

Modeling Principle: When there is little to choose between modeling

alternatives, follow the instincts of the domain expert.

Figure 6. The separate object approach to options and contracts.

Both this and Figure 5 are reasonable alternatives, although this

analysis builds on Figure 5.

3. Product

Derivative trades have long been considered somewhat risky, mainly because of

the complex mathematics required to evaluate risk. The Black-Scholes equation

which serves as the building block for much of the evaluation process, is a

second-order partial differential equation. Even with an engineering background,

these animals still give us the willies.

The most spectacular example of the pitfalls of derivatives trading is the

collapse of Britain's venerable Barings Bank. According to current reports, the

primary cause of the collapse was dealing in a particular kind of derivative

called a straddle—an example of a combination option. Combination options

can be seen as a composite of other options. It seems appropriate to discuss

this section with straddles as an example.

The concept of a straddle is in fact very simple. You have a holding worth some

$70 million, depending on prices, and you are concerned about any large

change in its value over the next three months. Either going up or down will

cause a problem. To avoid the problem, you can buy a call and a put, both with

a price of $70 million and an expiration in three months. Let's assume the

premium on each of these is $2.5 million. If the price goes up you exercise the

call and you gain the value of the holding at the new price, less $70 million

and the $5 million total premium. Thus if the value of the holding rises above

$75

million you are happy. Similarly if the value falls below $65 million you are

happy. The worst thing that can happen is that the price stays steady, in which

case you lose the $5 million premium. The attractiveness of a straddle comes

from a fixed risk that covers an otherwise very wide range of movement.

Naturally a very volatile instrument can result in a higher premium for the

straddle, but if you are trying to reduce your risk in a volatile environment,

this

can be a very useful product.

If you are the seller, of course, you are faced with a more tricky prospect: You

can lose an unlimited amount of money if the price moves a large amount.

This is indeed what caused a certain bank to lose its barings. Again, the bank

should have used other trades to hedge this risk.

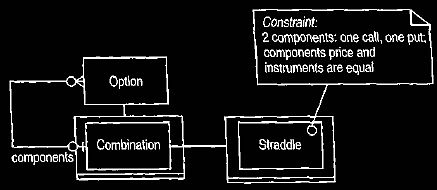

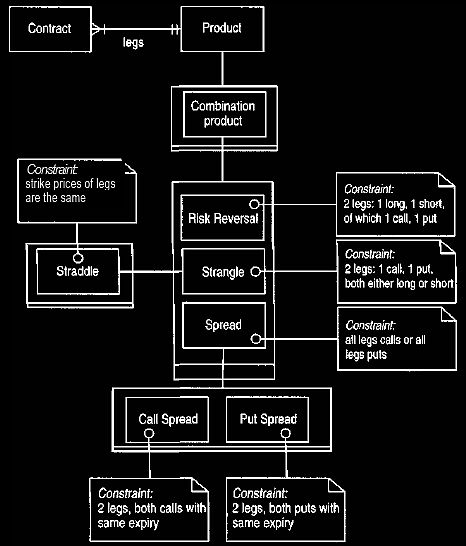

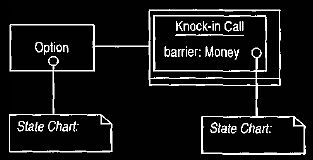

In modeling this straddle we should immediately note that it is composed of two

options that are constrained by their prices, dates, direction, and

instruments. Figure 7 shows a straddle modeled as a sub-type of an option.

As a combination option it can have components, with the constraint on the

straddle defining the precise characteristics. Other sub-types of combinations

would be used for other common cases: spreads, strangles, and the like.

Figure 7. Modeling straddles as sub-types of options.

A straddle is a combination of a call and a put.

Use of the sub-type confirms that a straddle is a kind of option and has the same

behavior as its super-type. This raises a question, however. Some behavior

can be safely inherited, such as the ability to value itself and the trade date.

We can think of the premium as the sum of premiums of the component options.

But what about the price? For a straddle, the components are all priced the

same, so we could consider it to be the price of the straddle. Another common

combination, however, is the spread. As previously mentioned, a spread is two

options, but both options are the same direction (that is, two calls or two

puts)

at different prices. What is the price in this case? Going back to the straddle,

is it a call or a put?

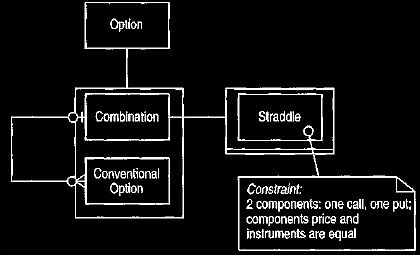

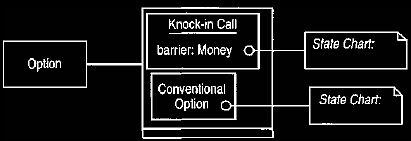

Figure 8 shows one way of dealing with this problem. Those attributes that

can make sense at both levels can be put on an option, while the awkward

attributes

are placed on a conventional option. This helps to some extent but begins to

fail as we recall that price was defined on the contract not the option,

and that there are combinations (such as covered calls and protected puts) that

combine options with regular contracts. Again, the generalization could be

manipulated, but one wonders what could safely be put on the super-type.

Figure 8. Separating the sub-types into combination and conventional.

These concerns are enough to raise a serious question about using composition

and sub-typing together. The main problem is that, when managing risk,

traders do not actually concern themselves with combinations. A combination is

nothing more than the component contracts. We consider its risk the same as if

the contracts were sold to separate counterparties in the same portfolio. It is

the customer and the salesperson who form the combination

and think of the contracts as a combination. Once the combination is dealt it

behaves no differently than any other contract.

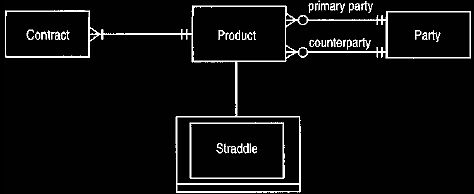

This leads us to the model shown in Figure 9. Here the salesperson's view

is explicitly separated from that of the risk manager. The risk manager sees

contracts, which are assembled into a product by a salesperson. The straddle is

now a particular kind of product. This allows us to reconsider the behavior of

the

contract and move the sales-related behavior to the product while leaving the

risk side of things to the contract. This includes the parties to the product

who

are generally irrelevant to risk management (unless exposure to a particular

party is being considered). Since contracts must have a product (due to the

mandatory

relationship), a contract can still find its parties by collaborating with its

product (but see the discussion about

Clinical Observations,

Section 1).

Figure 9 Introducing the product.

The product reflects the perspective of sales. In risk analysis the way in

which contracts are combined as products is ignored.

In considering whether to sub-type, we need to ask two questions. The first is

whether all the features of the super-type are really inherited by the sub-type.

An

immediate sub-typing, such as is shown in Figure 7, should be reviewed

against all the features of the super-type, including features of super-types of

the

super-type. It is easy to forget this and be led down a dangerous path. This

analysis will lead to refactoring the generalization hierarchy, and this

refactoring

may not be trivial. The second question we need to ask is, does the domain

expert really consider the sub-typing to hold? In our example the domain expert

resisted

sub-typing, preferring the Figure 9 model. Later on, the Figure 8

style did reappear but has not, so far, seemed compelling enough to change the

model (and

the framework that implements it).

Modeling Principle: Sub-typing should be used only when all the features

of the super-type are appropriate to the super-type and it makes sense

conceptually

to say that every instance of the sub-type is an instance of the super-type.

This leaves an interesting question as to whether it is worth putting some

explicit generalization structure on the product to represent the various kinds

of

combinations, as shown in Figure 10. Clearly it is not for risk

calculation purposes. It is useful, however, for creating new products of this

form. Indeed the

deepest examples of this kind of generalization are likely to lie at the

application and presentation layers where specific presentations are

required for pricing and deal capture of combinations. In such situations a

shared definition in the domain model is very valuable, even if the definition

is currently

used only in sales work. More sophisticated analysis of trades may require an

understanding of how these combinations are defined.

Figure 10 The common combination products.

This is a good example of a hierarchy based on constraints. The contracts

linked to a product are called the legs of the product.

Example: A client has a large holding in Aroma Coffee Makers stock and is

concerned about the movement in stock price over the next 6 months

before he can sell it. He might buy a straddle around the current price of $5.

To the trader this product is broken down into two separate options.

Example: we wish to buy 7000 shares of Aroma Coffee Makers. The trader is

not able to find a single other party who wishes to sell the exact amount.

He can find one party to sell 2000 shares and another to sell 5000 shares. we

have one product with the trader to buy 7000 shares.

The product consists of two contracts for each trade.

Modeling Principle: The product/contract split should be used whenever

the customer sees a single deal that is broken into several deals by the trader.

The key difference between a product and a contract is that the product

represents the customer's intention while the contract refers to what actually

gets

traded between the counter and primary parties.

3.1 Should a Product Always Be There?

One of the consequences of the model in Figure 9 is that non-combinations

are represented by a single contract and a single product.

The product is adding little to the picture (other than the separation of

responsibilities between sales and risk management).

Another possibility is not to make the link to product mandatory. In such a

scheme only a combination has a product. Simpler contracts have no product

link. A contract has links to a party, but they are derived when a product is

present. The disadvantage of this scheme is that it handles responsibilities

inconsistently. A contract is responsible for handling the relationships with a

party, except when it delegates the responsibilities to a product. This

inconsistency can lead to a great deal of confusion. For that reason we prefer to

use the model in Figure 9.

Traditional data modelers would come to the same conclusion from a different

route. Normalization leads them not to wish to duplicate the links to party

and thus choose a model like Figure 9 (although it might get altered for

performance reasons in a physical model). The object-oriented argument is

different because it focuses on having clear responsibilities, yet both

arguments share an underlying theme: Conceptual simplicity leads us to having

the

minimum of base associations. In OO development this principle leads us to

clearly separated responsibilities, and in relational data modeling it leads us

to 14th normal form (or whatever the number is these days).

Modeling Principle: Do not duplicate base associations that have the same

meanings.

Following this principle leads to types with well-separated responsibilities.

We can have as many derived associations as we like.

Modeling Principle: Be consistent in the allocation of responsibilities.

Be wary of a type that sometimes is responsible for something and sometimes

delegates that responsibility. (This behavior may be correct but it should

always be questioned.)

4. Sub-type State Machines

Although many common derivatives can be represented as combinations of options,

this is not uniformly the case. A barrier option can either appear or disappear

when the price of the instrument, as quoted on some agreed market pricing (such

as a Reuters page), reaches a particular limit. Thus an option could be bought

to buy (call) 10 million yen at a price of 90 JPY/USD, which would knock-in at

85 JPY/USD. This option behaves differently than a standard one. Effectively the

option

cannot be exercised unless the exchange rate falls below 85 JPY/USD before the

expiration date. If it does fall below this barrier, then the option is knocked

in and

will remain exercisable whatever happens to the price between that date and the

expiration. If the price never falls below the barrier level, then the purchaser

can

never exercise. (Barriers can also be knock-outs, in which case they can only be

exercised if the exchange rate does not pass the barrier.)

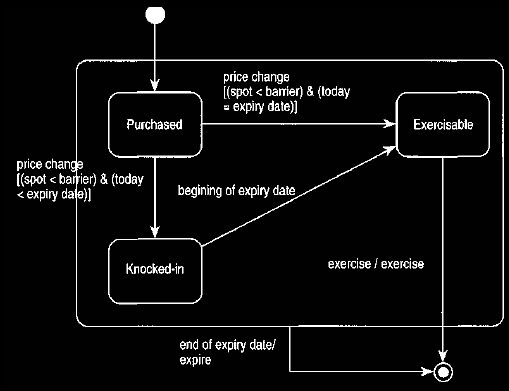

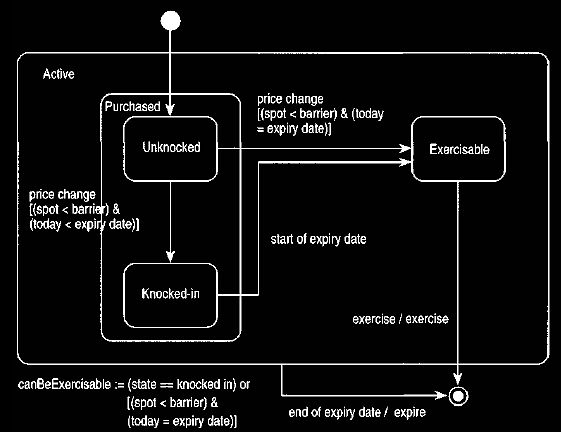

This different behavior can be expressed by a modification of the state chart

for a barrier, effectively replacing it with the one shown in Figure 11.

The event diagram for using it is shown in Figure 12. The only structural

change is the addition of the barrier level to the option, which does work well

as a sub-type

of option since it provides a change in behavior and adds a new feature (the

barrier level).

4.1 Ensuring Conformance of State

Charts

The state chart presents an interesting issue in its own right. We can replace

the state chart shown in Figure 4 with that of Figure 11, providing

the

different behavior of the barrier sub-type. However, this raises a question: Are

we allowed to do that? Most methods stress the importance of being able to

substitute a sub-type for a super-type; this is reflected in object diagrams by

only allowing us to add associations, not remove them. Many textbooks do not

mention what rules govern state diagrams with sub-types. Shlaer and Mellor

indicate that state diagrams can only be placed at either a super-type or a

sub-type.

However, if all sub-types share a common portion, that may be placed at the

super-type to ease maintainability (splicing). Rum-baugh [5] indicates that

sub-types can (usually) only add orthogonal state diagrams.

Figure 11. Harel state chart for a knock-in call.

If the instrument's price never passes the barrier, the option cannot be

exercised.

After the price has passed the barrier once, it does not matter what other

changes occur.

Figure 12. Event diagram of the process of using a knock-in option.

The best discussion of how sub-typing and states work is given by Cook and

Daniels, who devote a whole analysis to sub-types and state diagrams. They

stress the principles of design by contract which can be summarized by saying

that a super-type's state chart can be extended in two ways: either by

adding an orthogonal state chart or by taking a super-type's state and splitting

into substates. Super-type transitions can be modified only by redirecting them

to substates of their super-type's state.

Applying these guidelines to the option state models, we see a number of

problems. The first lies in the treatment of the start of expiration date event.

In

Figure 4 (the option diagram), this causes a transition from purchased to

exercisable, but in Figure 11 (the barrier diagram), the transition comes

from

the new knocked-in state. The end of expiration date event has a similar

problem: Figure 4 shows it transitioning from the exercisable state only,

while Figure 11 has it transitioning from any state.

The first question comes from considering what an object should do if it

receives an event that is not in a state in which we can do anything with it.

The

object can either silently ignore the event or raise an error. Some general

policy should be stated to interpret how to deal with this; for example, Cook

and

Daniels advise explicitly listing events in which an object is interested.

Any events that normally would be silently ignored if there were no defined

transition are listed as allowable events. This resolves what would happen

should the Figure 11 (barrier) diagram receive a start of expiration date

event

while in the purchased start. If start of expiration date is an allowed event,

it will just ignore it.

However, this is still not entirely consistent with the super-type. Figure 11

shows that when the start of expiration date event is received, a purchased

option changes to exercisable. Looking at this in contract terms, the change to

purchased is part of the post-condition of start of expiration date. We cannot

weaken this post-condition in the sub-type, only strengthen it. To have a

knock-in call as a sub-type of an option, we must replace both state charts with

those

shown in Figures 13 and 14.

Figure 13. Modified state chart for option to allow Cook and Daniels

conformance with knock-in calls.

Figure 14. Modified state chart for knock-in calls to support conformance

with Figure 13.

To provide conformance, these diagrams reflect two changes. The first is to

generalize purchased and exercisable into an active state. We can then redirect

the end of expiration date event from here. The second modification is to add

canBeExercisable as a guard on the start of expiration date event. This

operation is a way of saying that the start of expiration date does not always

lead to the exercisable state. For regular options canBeExercisable is always

true. Sub-types of an option can override it for other behavior.

Figure 14 shows how this override occurs for knock-in barriers. We

introduce substates of purchased to indicate whether the barrier has been

knocked-in or not. We then split the source of the start of expiration date

transition and weaken the guard to show the unguarded transition. Since we

have allowed start of expiration date on the super-type, the barrier can ignore

start of expiration date when unknocked.

4.2 The Problems with Using Conformance

Having gone through this exercise of

gaining conformance, we should stop and ask ourselves a few questions about the

process. In our judgment Figures 4

and 11 represent simpler and clearer expressions of behavior than Figures

13 and 14. Thus, although we have gained conformance (at least

according to the Cook and Daniels definition), we have lost comprehensibility.

In addition, modeling the knock-in call caused us to change the super-type

diagram. It was perfectly good as it was—we only changed it because we needed a

different state chart that forced us to construct a conforming sub-type state

chart.

This implies that a new sub-type can force us to change super-type state charts,

unless we are clever enough to produce a remarkably flexible super-type state

chart. Unfortunately we don't think I'm that clever, so sub-typing is going to be

fraught with difficulties.

One solution to these difficulties is to recast the generalization hierarchy to

avoid needing to worry about conformance. We assumed that a knocked-in call

would be a sub-type of an option, each with their own state chart, as shown in

Figure 15. Another approach is to treat an option as an abstract type

without

its own state chart and create a conventional option sub-type to hold the Figure

4 state chart, as shown in Figure 16. This avoids having to worry about

the

conforming state charts, allows the more natural state charts, but does

introduce a separate type. It is also more consistent with the guidelines of

Rumbaugh and

Shlaer and Mellor, who do not discuss conformance between state models.

Figure 15 Knocked-in call as a sub-type of an option.

This is the natural approach, but how are the state models related?

Design by contract says that sub-types must satisfy their super-types'

post-conditions. However, that does not necessarily imply that the

post-condition on

start of expiration date should include the transition to the exercisable state.

If we choose not to include it as part of the post-condition, then the

Figure 16 Creating a conventional option type.

This can make it easier to cope with the state models, but it is not as natural,

original diagram is acceptable. The important thing is that start of expiration

date should be allowed in all cases; whether it causes a transition or not is

undefined.

This is, in fact, an example of a wider issue in using design by contract. Often

people say that the post-conditions of an operation should define all

changes to the observable state of an object. This principle is often advocated

by the formal methods community but is not true for design by contract. The

post-condition merely specifies the state that must hold at the end of the

operation. We can always indicate that nothing must change other than what is

specified,

but that is not assumed in the approach.

Indeed sub-typing makes such a restrictive post-condition dangerous. The whole

point of sub-typing is that the super-type cannot predict all the extensions

that sub-types might make. Using an overly restrictive post-condition cripples

the flexibility offered by sub-typing. Post-conditions define aspects of the

object's observable state that must be true. Thus any other changes can occur

providing they don't violate the explicit clauses of the post-condition.

Modeling Principle: The effect of generalization on state charts is not

well understood.

It is important to ensure that all events on a super-type can be handled by the

sub-type. Any state chart that can be sub-typed must allow unknown events.

Modeling Principle: A post-condition defines a condition that must be

true of the object after the operation. Other changes that are not mentioned

by the pos-tcondition can take place.

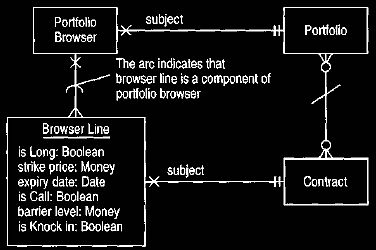

5. Parallel Application and Domain Hierarchies

Faced with a portfolio of various

contracts, a trader might like to look at a list of the contracts together with

important information about them. Such a list would

show each contract on one line. The information shown on the line would vary

depending on the kind of contract. The columns might be long/ short, trade date,

strike price, call/put (options only), expiration date (option only), barrier

level (barrier only), knock-in or knock-out (barrier only).

In this scheme some columns in the table are only relevant for certain sub-types

of the option. This adds a certain amount of complexity to the problem.

What we cannot do is assume that some browser line class asks each contract for

each relevant attribute. Such an approach would not work because the browser

line class cannot ask a non-option for its expiration date, since by definition

a non-option does not have one.

A first stage in laying out a design is to use the layered structure discussed

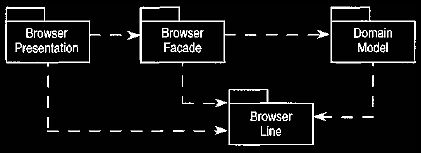

in Analysis 12. In using this the portfolio, browser and browser line types are

application facades operating as shown in Figure 17. The portfolio

browser's subject is a portfolio, the browser line's subject is a contract.

Neither portfolio

nor contract have any visibility to the portfolio browser or browser line, since

the latter types lie within the application tier and domain types have no

visibility

to application types (see Figure 12.6).

Figure 17. A portfolio browser and its relationship to the domain model.

A portfolio browser and browser line are application facades.

This structure allows a browser line to have attributes for all the columns

required by the interface. As far as a presentation programmer is concerned,

each line has these attributes, which may be nil. If an attribute is nil, then

that implies a blank space in the browser's table. The problem lies in the link

between the browser line and the domain model.

The browser line knows it is dealing with a collection of contracts.

Unfortunately it needs to ask for information that is only defined on certain

sub-types

of the contract. If a browser line asks a nonoption for its expiration date, it

will get an error. Several strategies can be used to deal with this interaction:

type

checking in the application facade, giving the super-type an encompassing

interface, using a run-time attribute, making the application facade visible to

the

domain model, and using exception handling.

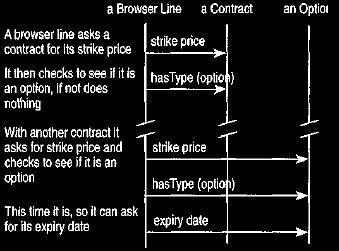

5.1 Type Checking in the Application

Facade

In this strategy the browser line is responsible for dealing with the problem.

Before each request to the contract, a type check is made on the contract to

ensure that the request can be issued safely, as shown in Figure 18. In

C++ this takes the form of a type check, followed by a downcast, followed by the

request.

Figure 18. Interactions for type checking in the browser line.

The type is checked before an operation is called that is only defined on the

sub-type.

This strategy has a number of disadvantages. The browser class, in the face of

many sub-types of the contract, becomes quite complex. Furthermore any changes

in the contract hierarchy causes changes in the browser. Of course, if the

change is a new sub-type that introduces a new column to the browser, then such a

change

would be required in any case, driven by a presentation change.

The degree of type checking that this scheme implies can be reduced by a couple

of approaches. We can use a subclass of browser line for each sub-type of

contract.

We can use a type check to instantiate the correct subclass of browser line to

do the job. Another approach is to use the Visitor pattern. Although these

approaches

are preferable if the degree of type checking is excessive, they still require

the browser line (and its subclasses) to know about the contract hierarchy.

5.2 Giving the Super-type an

Encompassing Interface

The essential problem is that it is an

error to ask a contract for its expiration date. One solution is to add all of

the sub-type operations to contract. Contract

would naturally reply with a nil for all of these, but the relevant sub-types

could override that operation to provide their value.

This approach has many problems. It becomes impossible to tell what is a truly

legal operation on a contract and what is really an error. Compile-time type

checking

is defeated because it cannot tell which is which. Each time a sub-type is

introduced, contract's interface must be altered. Thus I'm not a fan of this

approach.

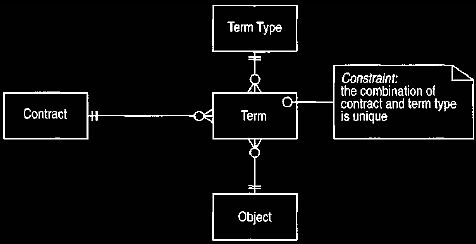

5.3 Using a Run-Time Attribute

Run-time attributes provide a very flexible system of adding attributes to types

without changing the conceptual model. When implemented they allow attribute

changes without recompilation during the execution of the system.

The basic model for contracts is shown in Figure 19, or preferably Figure

20, which uses a keyed mapping. All contracts have a number of terms, and each

receives

a term type. In this example each attribute of the contract and its sub-types

(strike price, is call, barrier level, and so on) would be term types. If a

contract is asked

for a term, it replies with the value object if there is a term. In this way it

is not an error to ask for a non-option's expiration date.

Figure 19. A run time attribute for contract.

This way asking a non-option for a property only defined on option would not

cause an error.

Figure 20. Figure 19 using a keyed mapping.

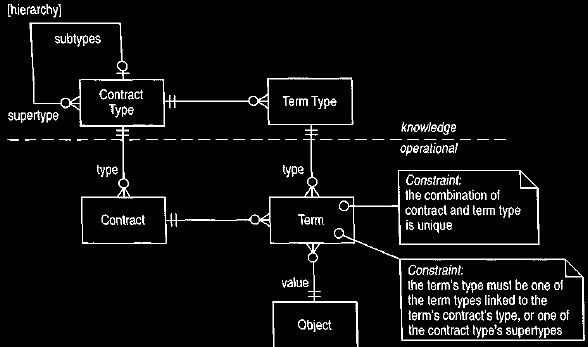

Of course, this model allows a non-option to be given an expiration date by

accident. This can be prevented in a couple of ways. The first is to use a

knowledge level (see Section 2.5), as shown in Figure 21. The other is to

treat the term type as a derived interface. Both the model attributes (those on

contract and its sub-types) and the term type interface are provided. Updates are

only provided through the model attributes.

Figure 21. Using a knowledge level to control the placing of terms on

contracts.

This would stop terms from being placed incorrectly on contracts but can only

be checked at run-time.

Using run-time attributes does provide flexibility but it comes with significant

disadvantages. First, using term types makes the interface of a contract and its

sub-types harder to understand. As well as looking at the operations defined on

the type, the user of a contract must also look at the instances of the term

type,

and indeed which instances are valid. Second, attribute types cannot be type

checked at compile time, removing a very important advantage of compile-time

checking. This does not matter for the browser line, since the whole point is to

relax any compile-time checking, but it does matter a great deal for other parts

of

the system. A third disadvantage is that the basic language mechanisms are being

subverted. The compiler is not aware of what is going on, and language

features, such as polymorphism, must be hand-coded by the programmer. Also,

run-time attributes do not perform as well as model attributes.

Many of these disadvantages can be mitigated by providing both interfaces. Those

parts of the software that know about attributes at compile time can use

the model attributes, and the browser can use the run-time attributes.

5.4 Making the Application Facade

Visible to the Domain Model

In this approach the responsibility

for loading a browser line is given to the contract that browser line is

summarizing, as shown in Figure 22. Since

control is now in the contract, or its sub-type, it can load the browser line

with the correct values for that sub-type. The browser line supports all

necessary

information for the application, and the contract or sub-type knows what is

applicable for that sub-type.

Figure 22. Interactions for contracts loading browser lines.

The browser line must be visible to the contract, which violates the usual

visibility rules between domain and application tiers.

The advantages of this approach include the fact that the interaction is much

simpler because no type checking is required, and a more complex interface is

not needed for the contract. In addition, adding a new contract does not require

the browser line to change, unless there is a corresponding change in the

presentation. All that is needed is a new overriding operation to load the

browser line.

The biggest disadvantage lies in the breaking of the visibility rules between

application and domain tiers that are discussed in Analysis 12. This can be

avoided by placing the browser line in its own package, as shown in Figure

23. In this way the dependency from the domain model is limited to only the

browser

line type. Visibilities may be further reduced by splitting the browser line

type into two. The presentation for the browser and the contracts use very

different

interfaces to the browser line. The browser line can be given its own browser

line facade in the browser facade package. This facade has a simple interaction

with

the browser line. In this case the visibility from the browser presentation to

the browser line package can be removed.

Figure 23. Visibilities for a browser line package (based on Figure 12.6).

The browser line package is a special case between the application and domain

tiers.

Another disadvantage arises from the possibility of several browser applications

that may have slightly different needs.

Each application would need its own browser line, which would all need to be

known by contract. The splitting of browser line can help here.

One browser line facade would be created for each application, all of which

would use the single browser line package.

Adding new kinds of browsers thus would not alter the contract's

responsibilities unless a new feature were added to the browser line.

The fact remains that any new feature required of the browser line requires

modification of the entire contract and all its sub-types. This is the

fundamental

trade-off between putting control in the browser line as opposed to putting

control in the contract. If new contracts are added more frequently than

features

are added to the browser line, then we should put control in the contract.

However, the change to the normal pattern of visibility is not to be taken

lightly.

Unless new contract sub-types occur significantly more often than changes in the

browser line, we would not put control in the contract because many new sub-types

in the contract would themselves imply new features to the browser line.

5.5 Using Exception Handling

Of course all of the above ideas are

based on the idea that it is a bad thing to ask a non-barrier for its barrier

level. With the right environment, however, this is not

such a problem. If making a request of an object results in a run-time error and

that error is made manifest through an exception, then the browser line can

simply catch the exception and treat it as a nil. The browser line should check

that the exception is actually a result of the receiver not understanding the

request

and not some other, more worrying error. It also assumes that it is possible to

send a message to an object for which the receiver does not have an interface.

This is where a lack of type safety becomes an advantage, coupled with the

exception handling features now present in the newer implementations. Smalltalk

can always be used in this way, since it is untyped. Type safety can be bypassed

in C++ by using a downcast.

|