|

Analysis of Exchange Trading Business

This analysis is based on a project to develop a

foreign exchange derivatives

trading system for a major bank.

This analysis looks at the buying and selling of goods and at the value

of these

goods with respect to changing market conditions. Using the

experience of building a trading system for a bank, the analysis looks at

buying and selling from both angles, where the bank buys and sells the same

goods. The bank has to understand the value of the net effect of these trades in

different circumstances.

Each trade is described by a Contract (Section 1). The

contract can either buy or

sell goods and is useful for businesses that need to track both

directions of deals.

We can look at the net effect of a number of contracts by

using a Portfolio (Section 2).

We design portfolios so we can assemble them easily to select

con tracts in different ways. We give the portfolio a separate object, the

portfolio filter, to define the selection criteria. The portfolio filter defines

an interface that can be implemented by various sub-types. This construction provides

flexibility for simple and complex selection criteria. It is a useful technique

for defining collections in a flexible manner.

To understand the value of a contract, we need to understand the price of

the goods being traded. Goods are often priced differently depending on

whether they are bought or sold. This two-way pricing

behavior can be captured by a Quote (Section 3).

In volatile markets, prices can change rapidly. Traders need to value

goods

against a range of possible

changes. The Scenario (Section 4) puts together

a combination

of conditions that can act as a single state of the market for valuation.

Scenarios can be complex, and we need a way to define their construction

so we can use the same scenario construction at different times in a consistent

manner. Scenarios are useful for any domain with complex price changes.

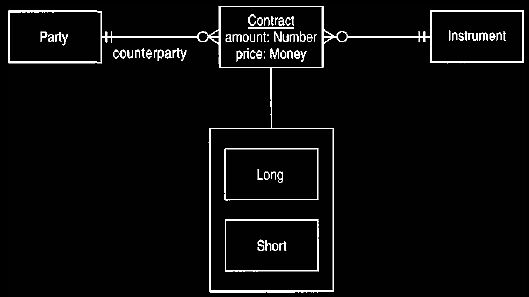

1. Contract

The simplest kind of financial deal is

that of buying some instrument from another party. The instrument can be stock,

a commodity, foreign exchange, or

any other commonly traded item. A basic starting point is the model shown in

Figure 1. This model has a contract that is a deal with another party, referred

to

as the counterparty, involving some amount of an instrument. Only a single

instrument is shown, although strictly speaking all trading involves two

instruments - one instrument being traded for another. For most markets one

instrument is always the currency prevailing in the market. The price is thus

represented as a money object. Money is a sub-type of quantity (see

Clinical Observations)

whose unit is a currency.

In foreign exchange markets the instrument is the exchange rate. This might seem

odd, but really all instruments are exchange rates. A contract to sell stock

on the Dow is really a contract to exchange stock for dollars. In most cases it

is easier to represent this by saying that the instrument is exchanged for the

currency of the price, but for exchange rates it is better to have both

currencies on the instrument and let the price be a simple number.

Figure 1 Simple model for a contract.

The amount of the instrument is traded with the counterparty. Long and short

are terms for buy and sell, respectively.

The single counterparty limits the contracts that can be represented.

The terms long and short are the terms traders use for buy and sell,

respectively. (Computer people are not the only ones with strange jargon!).

Figure 1 shows the difference between long and short with sub-typing notation. An

alternative is to have a Boolean attribute isLong. Either method is acceptable,

but we prefer the explicitness of Figure 1 in conceptual modeling. Sub-typing and

a Boolean attribute are equivalent in conceptual modeling; sub-typing does not

imply subclassing. In an implementation modeling technique (when sub-typing does

imply subclassing), Figure 1 is not appropriate unless the behavior of the

long and short differ (and possibly not even then). An interface model can go

either way.

This transformation can be made to preserve the same interface whether

subclasses or flags are used.

Example: Megabank sells 1000 shares of Aroma Coffee Makers stock to

Martin Fowler at $30.

This is a short contract whose counterparty is Martin Fowler, the instrument is

Aroma Coffee Makers stock, the amount is 1000, and the price is $30.

Example: Megabank sells 2 million US dollars (USD) for 1 million British

pounds (GBP) from British Railways.

This is a long contract in which the counterparty is British Railways, the

amount is 1 million, the price is 2, and the instrument is GBP/USD.

Alternatively it

could be a short contract in which the amount is 2 million, the price is 0.5,

and the instrument is USD/GBP.

Example: Northeast Steel sells 10,000 tons of steel to Chrysler. For

Chrysler this is a long contract with a counterparty of Northeast Steel.

The instrument is steel, in which case the amount changes to a quantity to allow

10,000 tons to be represented.

(An alternative is to allow the instrument to be tons of steel, but that is less

flexible for other quantities.)

This style of model is good for capturing deals done between the host

organization and other parties. Often, however, deals are done internally within

the host organization, such as between the options desk and the commodities

desk. These internal deals are used in the management of risk. A common

example is a deal to offset the risk of an option (called a hedge). Such

internal deals raise the question of who is the internal party.

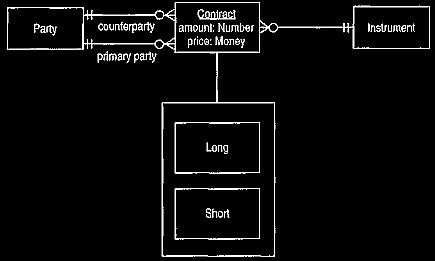

The model shown in Figure 2 presents a more flexible way of answering this

question. Two parties are shown on a contract: the long (buyer) and the short

(seller).

Figure 2 Indicating buyers and sellers by separate relationships.

Having two parties supports internal deals, completely external deals, and

dealing with different parties within the host organization.

In this kind of representation, the options desk and the commodities desk are

represented as separate parties. If the options desk does an option with an

external party and hedges it with a deal with the commodities desk, then the

options desk would be a party to each contract. If the options desk were the

long

party in the option, it would be short in the hedge contract.

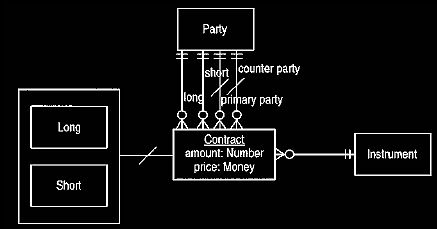

Figure 3 represents a similar situation in a slightly different way. Again the

use of two relationships allows internal deals to be represented. However, here

there is a notion of primary party and counterparty rather than long and short.

The host bank party is always the primary party when doing a deal with an

outside organization. In internal deals the choice between primary party and

counterparty is arbitrary, although by convention the primary party is usually

the

one that initiates the deal. The sub-type of long and short is the nature of the

deal as seen by the primary party.

Figure 3 Counterparty and primary party.

This is less concise than Figure 2 but can better support the traders' view.

On initial analysis the model shown in Figure 3 looks less valuable than the

model shown in Figure 2 because it adds an extra pair of sub-types without

any great advantage. Certainly a data modeling view would reject this on the

basis of a more complex data structure. The important issue, in terms of OO

modeling, is interface. Is it more useful to provide operations that ask for

primary and counterparty and the contract as long or short, or is it more useful

to

have a long and short party? It may be that the model shown in Figure 4, which

essentially provides both interfaces, is the best. The deciding factor is what

is

most useful to the users of the concepts. For our example system, the Figure 3

model was more meaningful to the traders than that of Figure 2 and proved more

useful in constructing software, although the Figure 4 interface was ultimately

provided.

Figure 4 Using four party mappings.

This covers all points of view by deriving the duplicate elements.

Modeling Principle: When more than one equivalent set of features can be

provided, pick the one that the domain expert is most comfortable with.

If the domain expert feels that both are very valuable, show both and mark one

derived.

The choice of what to make derived in Figure 4 is quite arbitrary. We could

equally well make the long or short mapping derived. The model should

not constrain the implementor who can use either kind of implementation. It

could be argued that you could make nothing derived but simply use rules (such

as, if the contract is short, then the short party is the same object as the

primary party). We prefer to show some derivations to make the interrelationships

explicit,

but ultimately it is more a matter of modeling taste.

Modeling Principle: Marking a feature as derived is a constraint on the

interface and does not affect the underlying data structures.

A consequence of the models shown in Figures 2-4 is that contracts can be

recorded that do not involve the host bank. We can avoid this by forcing at

least the primary party to be a party of the host bank. Alternatively we can ask

the domain expert if holding these deals would be useful. Salespeople often like

to record deals that their customers have made with other banks because it gives

them information on their customers' possible risk profiles and allows them to

sell a contract to improve matters. Here the flexibility of the model supports

new business capabilities.

An open issue is the relationship between a contract in this trading model and a

transaction in one of the accounting models from

Analysis of Inventory And Accounting.

A trade can be seen as a transaction that, for example, withdraws 1000 shares of

Aroma Coffee Makers stock from a Megabank account and deposits them in a buyer's account, while transferring the appropriate amount of money in the

opposite direction. Both trades and transactions are useful, but for different

purposes. More modeling needs to be done to explore their interrelationships.

2. Portfolio

We rarely consider contracts alone, especially when we are managing risk.

Typically a bank will look at a group of related contracts and assess their

joint

risk. This might be the contracts dealt by a single trader, the contracts in a

particular instrument, the contracts with a particular counterparty, or some

other combination.

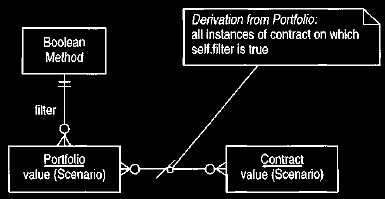

In essence a portfolio is a collection of contracts, as shown in Figure 5.

Portfolios and contracts can be valued by pricing them according to some

scenario. A scenario is a representation of the state of the market, either real

or hypothetical (we will discuss scenarios in more detail in Section 4). The

value of a portfolio is essentially the sum of the values of the underlying

contracts.

Figure 5 Introducing portfolios.

A portfolio is a collection of contracts that can be valued as a whole.

A key question lies in the cardinality of the mapping from contract to

portfolio. Whether a contract can sensibly lie in more than one portfolio

depends

on how we create and use the portfolios. If a portfolio is a trader's book, then

a contract lies in the portfolio of the trader who is managing the deal. This,

however, does not allow all trades with a particular counterparty to be

considered together. Thus there seems to be an advantage in allowing a contract

to lie in many portfolios. Portfolios can thus be built to manage risk according

to different perspectives.

Using portfolios in this way raises another question, however. Suppose we need

to form a portfolio that contains all contracts done with a particular

counterparty. We could build an application that would search all contracts and

assign them to portfolios. A better way, however, is to get the portfolio to

assign

contracts. We can give a portfolio a Boolean method, which takes a

contract as an argument as shown in Figure 6. The portfolio then consists of all

contracts for which the Boolean method evaluates to true. This allows us to

construct portfolios that can select any combination of properties of a contract

and then carry out the management functions of a portfolio on this derived set.

Figure 6 Dynamic portfolios with filters.

This allows portfolios to be described implicitly by properties of the

contract.

Modeling Principle: If a set of objects can be formed with various

criteria, a portfolio should be used.

Allowing portfolios to have methods so that they can form themselves with

contracts is a powerful notion. It means that there is no need to choose a

single

structure to consider groups of contracts. Various structures can be used, in an

ad hoc manner. Once such a structure is defined, it can be remembered as used

in the future and its contents regularly updated. The structure can be defined

at any time, long after the original contract was put together. In effect we are

making a query, and the resulting collection of objects becomes an object in its

own right.

How is the Boolean method implemented? In general the method can be any block of

code that returns true or false when given a contract as an argument.

Smalltalk programmers can see that assigning a single argument block as an

instance variable of portfolio would provide the desired capability.

C++ programmers can use roughly the same principle, although it is more tricky

since C++ needs a compiled function.

This is the same problem as the individual instance methods discussed in

Analysis of Inventory And Accounting, Section

6.

In the abstract the Boolean method might be the best approach, but in practice a

simpler method does as well. Portfolios are commonly formed from a

number of properties of contracts, including counterparty, dealer (the primary

party), instrument, and dates of the deal. We can combine these attributes into

a

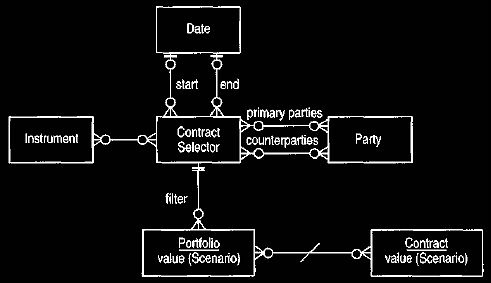

particular contract selector object, as shown in Figure 7. A contract selector

is not as general as a Boolean method and can only handle a

limited range of filtering. However, it is easy to set up; the user can

configure it easily with a suitable user interface. If we use a contract

selector to handle most

of the portfolios needed by the user, we can considerably reduce the amount of

programming required.

Figure 7 Contract selectors.

Note that this is an example of a parameterized method (see Section 6,6.4).

It cannot select all possible portfolios,

but it can cover most portfolios used in practice more easily than the

completely general case.

Example: A portfolio consists of all deals involving Aroma Coffee Makers

stock sold to John Smith.

This portfolio has a filter with Aroma Coffee Makers stock as an instrument and

John Smith as a counterparty.

We are not forced to choose between contract selectors and Boolean methods for

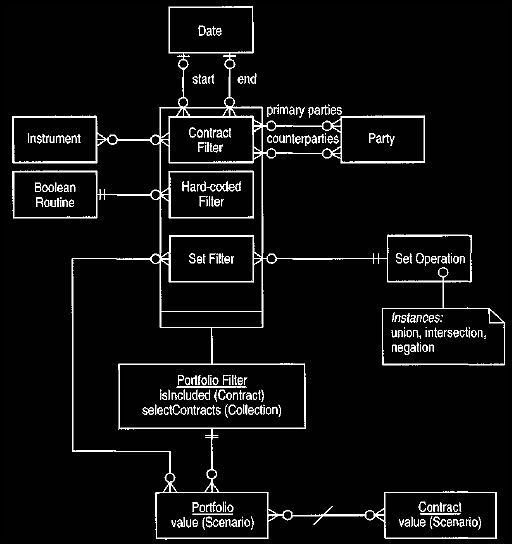

our filters. We can have the best of both worlds by using the model shown in

Figure 8. This model abstracts the interfaces of both the Boolean method and the

contract selector into a single, abstract type—the portfolio filter. This allows

us to use the contract selector for simple cases and use a range of hard-coded

fiiters for more complex situations. We can easily add other portfolio filters.

This

is an example of the strategy pattern.

Modeling Principle: When making a process a feature of a type, the

process should be given an abstract interface so that the implementation can

easily vary

by subclassing. A purely hard-coded implementation is one subclass, various

parameter driven approaches are others.

Figure 8 Provision of several portfolio filters.

This model provides both flexibility to handle the complicated cases and simple

parameterization for the simple cases.

It is a combination of strategy and parameterized implementations in

Analysis of Inventory And Accounting, Section

6.

The select operation on the portfolio filter takes a collection of contracts and

returns another collection of contracts. For each contract in the input

collection, the select operation evaluates is included and, if true, adds it to

the result. Subclasses of the portfolio filter override is included to provide

their

specific behaviors. A portfolio may use is included to check individual

contracts.

We should add a word about the naming of portfolio filter and contract selector.

Some people find the distinction between the terms quite valuable in

practice. A selector selects objects of the type it is named after;

thus a contract selector is used to select contracts, and it returns a

collection of contracts. A filter selects some other type on behalf of its named

type

and is designed to be used with its named type. Hence a portfolio filter selects

contracts for a portfolio. By sticking to a consistent naming,

it is easier to remember the responsibilities of these two kinds of objects: The

filter is only a selection mechanism, but the portfolio adds additional

behavior,

such as producing an overall value. In addition, the portfolio is referred to by

other parts of the system, while the filter is only used for selection purposes.

Portfolios can be transient or persistent. Transient portfolios are filled on

demand. The filter is specified, and all instances of the contract are checked

to

see if they match the filter. Once a client has finished with the portfolio, it

is discarded. Persistent portfolios are created in the same way but are not

discarded.

When new contracts are created, they are checked against existing persistent

portfolios. If they match the filter, they are added to the portfolio. Any

processing based on the portfolio must then be updated, ideally incrementally.

Persistent portfolios provide much faster query performance but slow down

creation of contracts and use up storage. An essential modeling principle is

that users should be unaware of whether portfolios are transient or persistent.

Portfolios should switch from one to the other without requiring any action by

the user. This requires that a new portfolio filter be checked against any

existing

persistent portfolio filters. If a matching one exists, then the existing

portfolio should be referenced rather than a new portfolio created.

Portfolios are useful in many domains. The essential characteristic of a

portfolio is that of an object that encapsulates a selection mechanism for

choosing a group of objects of some type. The portfolio acts as a basis for some

further summary processing. This processing can be a client object, as in this

analysis, or it can be built into the portfolio itself.

Example: A car manufacturer can develop portfolios of produced cars for

summarizing production and fault data. Filters can select cars according to

their plant, model, shift of production, or some date range.

Example: Public health is a significant branch of health care that deals

with the health of populations of patients.

We can select populations according to a range of characteristics: age, where

they live, observation concepts that apply, and so on. These populations can

be defined by filters, and then observations can then be made about them, such

as the average peak flow rate for people who smoke more than 20 cigarettes a

day.

(The population is a portfolio of people where the filter is 'smokes more than 20

cigarettes a day'.)

3. Quote

Anything traded on a financial market has a price. That price, however, is not

usually a single number. Two numbers are quoted: the price to buy (the bid) and

the price to sell (the offer). We can model this using a pair of numbers to

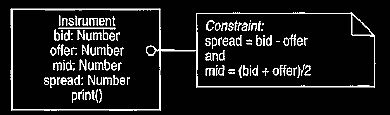

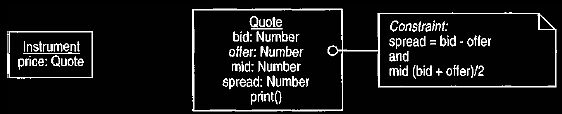

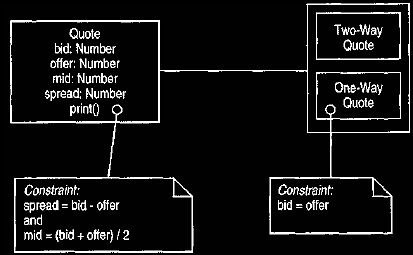

represent the prices, as shown in Figure 9.

Figure 9 Representing the price through two numeric properties.

An instrument can be valued using numbers or money objects. Typically stocks

are valued using money but exchange rates have numbers. A quote

behaves the same in either case. (We can think of a quote as a parameterized

type.)

Although two numbers are common, they are not always used. Sometimes the quote

is a single price, which represents the mid-value of the price. A single

price is quoted with a spread—the difference between the bid and the offer. On

other occasions we may see only a bid, or only an offer. This affects the

way the quote is displayed. In foreign exchange markets an exchange rate such as

USD/GBP might be quoted as 0.6712/5, which indicates a bid of 0.6712 and

an offer of 0.6715. If only a bid is present, the quote is shown as 0.6712/; an

offer-only quote appears as /0.6715.

Any object that may have two-way pricing—such as exchange rates, commodities,

and so on—requires a number of behaviors as shown in Figure 10.

Pulling these behaviors out into a separate quote object, as shown in Figure 11,

provides all behaviors needed for two-way pricing. Anything that has a

quote as a price requires a quote property.

Figure 10 Behaviors required to support two-way prices.

A quote becomes a fundamental type and as such can best be represented as an

attribute in those modeling methods that distinguish between attributes and

object types. It is important to remember that an attribute does not represent

the data structure, merely the presence of suitable operations.

Figure 11 Using a separate quote object.

This is a good approach since it brings the particular responsibilities

together into a simple reusable concept.

Example: The USD/GBP rate is 0.6712/6. The instrument is USD/GBP. This

instrument has a quote with a bid of 0.6712,

an offer of 0.6716, a mid of 0.6714, and a spread of 0.0004.

Example: A CD exchange sells used full-price CDs for $12 and buys them

for $8. The bid is $12, the offer is $8, the mid is $10, and the spread is $4.

The instrument is a full-price classical CD (even for a Chopin nocturne).

Modeling Principle: When multiple attributes interact with a behavior

that might be used in several types,

the attributes should be combined into a new fundamental type.

Two-way prices are common, but sometimes one-way prices are used. Modeling

one-way prices is somewhat tricky. One alternative is to allow the

price either to be a quote or a number. This is nearly impossible in strongly

typed languages such as C++. Even in Smalltalk the client of stock is forced to

determine what kind of object the price returns before doing anything with it.

An alternative is to make the quote a sub-type of the number. This can work

because quotes can respond to arithmetic operations, but it still forces the

client

to be conscious of the differences whenever manipulating stock prices, other

than for printing. In C++, where number is not a built-in type but real and

integer are, this method should not be used unless a number class is provided.

Another alternative is to make number a sub-type of quote. Conceptually this has

a definite appeal. Numbers are just simple quotes, and it is not too difficult

to consider that every instance of a number is an instance of a quote, with

identical bid and offer. (A similar argument can be used to say that number is a

sub-type of complex number.) Although the argument has conceptual merit, it falls

down with an interface model. For a number to be a sub-type of a quote, it

must inherit the complete interface of the quote. A quote is only useful for a

few domains, while a number is useful in almost every domain. Sub-typing from a

quote means that the quote is used in all domains, including many where the

quote's behavior is not useful. A quote must be designed so it has visibility to

number, and not the other way round.

Modeling Principle: A generalization should not be used where the

super-type is in a narrow domain and the sub-type is widely used.

At this point we should consider what commonalities exist between quotes in

their two-way and one-way forms. Two alternatives exist: Either a one-way quote

is treated as a quote, with the bid equal to the offer, or it is an error to ask

for a bid or offer on a one-way quote. The former points to the presence of an

abstract

quote, as shown in Figure 12, while the latter avoids any such generalization.

In the first alternative the client can treat the one-way and two-way quotes

with the

same behavior and not be concerned with differences. However, this can lead to

inaccuracies because the client cannot be sure of dealing with the bid of a

two-way quote. A type test operation (i sTwoWay or hasType ('TwoWayQuote')) is

needed so that the client can make the test. With no abstract quote, these

inaccuracies cannot occur, but the client must use the type test every time an

operation is invoked to know whether the operation is safe to use.

Figure 12 Abstract quote with sub-types.

One-way prices are treated as a special case of two-way prices.

The decision hinges on how often it is acceptable to ignore the difference

between two- and one-way quotes. If it is almost never acceptable, then it is

best not to have an abstract quote type. However, if it is frequently acceptable

(which practice suggests it is), then we would strongly encourage the use of an

abstract quote type. It is important to note that using the abstract quote never

requires more effort by the client than not using one. It saves effort when the

distinction is not required.

Modeling Principle: If the difference between two similar types is often

ignored, then an abstract super-type can be used. If the distinction between them

is usually important, then an abstract super-type should not be used.

Modeling Principle: If an abstract type never needs more effort for a

client to use it, then it should be provided.

The abstract quote subsumes all the behavior of the sub-types because there is no

additional operation or association on the sub-types. Typically we do not

use subclasses to implement the sub-typing of an abstract quote, especially since

such a fundamental object usually uses containment in C++. An internal flag in

a quote class is a more likely implementation, especially since we often need to

par a two-way quote (that is, turn it into a one-way quote) and vice versa,

which

requires dynamic classification.

An implicit quote can be either a buy or a sell, in which case two-way prices

are not needed. Only when both buying and selling are required are

two-way quotes needed.

Sometimes we want to represent the price of a contract as a quote. Often when

counterparties ask the price for a contract, they do not specify the

direction; in that case the trader replies with a quote. By holding on to the

quote, the trader remembers what the spread was when the contract was quoted.

The

actual amount charged can easily be derived from the direction of the contract

and the quote.

4. Scenario

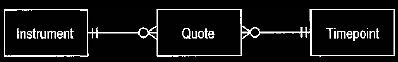

The price of an instrument is never constant; otherwise, the stock markets of

the world would be much less interesting places. We need to be able to show how

prices can change over time and to keep a history of those changes. We can do

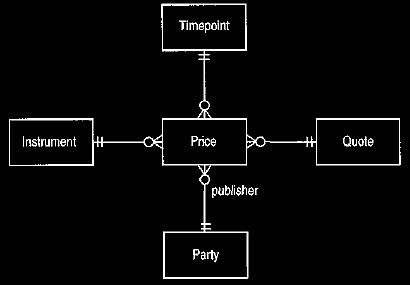

this by placing a timepoint on the quote, as shown in Figure 13, or by placing a

timepoint on the relationship between the instrument and the quote, as shown in

Figure 14. The difference between the two methods is small but significant. In

the former, the quote is responsible for both its two -way nature and its

time-dependent behavior. In the latter method those responsibilities are

separated.

Since we see a quote as a fundamental type that should kept as simple as

possible, we prefer to use the approach shown in Figure 14.

Figure 13 Adding a timepoint to a quote.

The timepoint indicates at what time the quote is correct for the instrument.

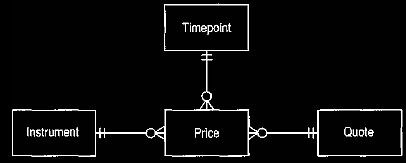

Figure 14 A price made for a stock at a particular time.

This separates the two-way behavior (quote) from the notion of a value for an

instrument at a timepoint (price).

In these models, finding the closing prices for a market involves taking all

the stocks within that market and looking for the latest quotes for each stock.

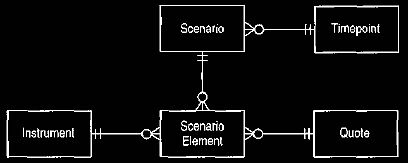

Another alternative is to treat this collection of quotes as an object in its

own right—a scenario, as shown in Figure 15.

Figure 15 Scenario

This allows a group of prices at a single time to be treated as a single

object.

The scenario represents the state of the market at a certain point in time, and

the elements within the scenario represent the prices at that point.

If we only want to capture the published prices of a stock exchange, then a

scenario seems to add little to the picture. It is easily generated by looking

at

the timepoints in the non-scenario model. The important question here is where

the trader gets prices. One source is the exchange's public quotes. For those

that manage funds of stocks, another consideration is possible future prices.

Much of the effort of fund managers and traders goes into managing the risks

of their portfolios as market conditions change. This risk management involves

looking at alternative situations and considering their effects on prices of

assets.

Example: A fund manager is managing a portfolio of stocks. She is

concerned with the possibility of a fall in oil prices, which would boost the

prices of

many stocks but decrease the price of others, such as oil companies. This

manager wants to look at several falls of differing magnitudes and consider

how they affect a portfolio. Each of these falls leads to a different scenario.

Example: A production manager is assessing likely production costs for

cars. The costs of raw materials and labor are instruments concerned with

pricing.

Several scenarios can be constructed with different likely values for these

instruments.

The above examples are hypothetical cases that show the strength of the scenario

approach. The scenario object provides a base to pull together all the

factors in a hypothetical case so that different cases can be compared easily.

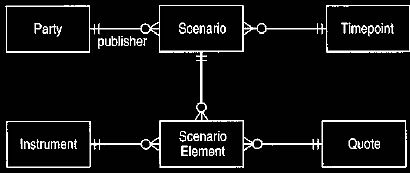

We also need to consider markets that do not have a single publisher for a

price, such as the foreign exchange market. In such cases we need to add the

party that is publishing the price to the model. Figures 16 and 17 show earlier

models with publishing parties added. Both the scenario and non-scenario

approaches are effective, and again the need for hypothetical scenarios for risk

management is the deciding factor.

Figure 16 Model in Figure 14 with a publishing party

Figure 17 Model in Figure 15 with a publishing party.

Using a publisher is one more reason to use a scenario.

Example: An import/export merchant considers the prices of goods in a

number of European countries. We can describe these prices by forming a scenario

where the instruments are the goods he is interested in trading. By looking at

the differences between these markets, using two-way prices, he can look for

opportunities where the price difference is greater than the cost of

transporting the goods (a process referred to as arbitrage).

Modeling Principle: Scenarios should be used when a combination of prices

or rates should be considered as a group.

4.1 Defining How to Build a Scenario

Where do prices come from? In some cases this can be a simple question, for

instance, when prices are published by an exchange. In other cases,

particularly when there are hypothetical scenarios, more complex schemes might

be used.

In broad terms we can see three origins of a price: publication by some body

that is widely quoted in the market, calculation from other prices or

market characteristics, or the opinion of an individual trader or team of

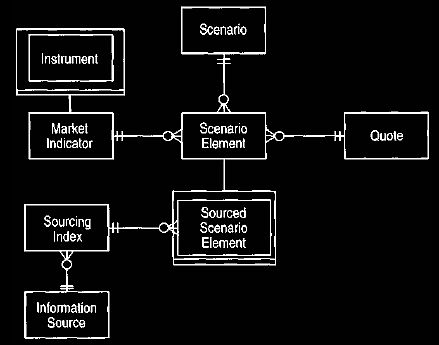

analysts. The first case, shown in Figure 18, is the most straightforward.

Instructions

are required to source the relevant information. Typically these instructions

come from a source, such as Reuters, that tells where to look for information

(for example, "Page 3, second column of the row starting IBM").

Figure 18 Sourcing a scenario element.

This model describes where a particular element comes from.

In effect, using a published price makes the quote for a sourced scenario

element derived. Rather than asserting the quote for a sourced scenario element,

we derive it using the sourcing index. There is thus an argument for making the

link to a quote a derived link. This can be done safely if the link can never be

asserted, as when a trader records a hunch. Asserting the quote can cause

problems because sometimes the quote can be asserted and sometimes derived.

One way out of this is to use a notation for hybrid or option ally derived

relationships (see Odell [2], page 56). This seems to take the derived issue too

far. We tend to notate according to the most common case and describe what

happens precisely in the supporting documentation.

Example: An analyst looking at prices for mail order goods can treat each

company as an information source. The sourcing index can be a page number in a

catalog.

There can then be a separate scenario for each retailer, or an overall scenario

can be built that combines all retailers. Rather than asking for the price of an

instrument,

questions such as lowest price and average price of some instrument are

supported.

Figure 18 introduces market indicator as a super-type of instrument. This

reflects the fact that scenarios can contain things other than instruments.

For derivatives, an important part of the pricing approach is the volatility of

an instrument—a number that indicates how much the value of the instrument is

changing. This volatility is not an instrument that can be traded, but it is

recorded in a scenario in the same way as an instrument. Hence a market

indicator includes volatilities, as well as all instruments.

Example: Foreign currency markets have many market indicators that are

not instruments, including interest rates on the various currencies and the

volatility of

an exchange rate—an indication of how much the exchange rate is changing.

Example: An analyst looking at prices for mail order goods is interested

in the increase in jeans prices.

Jeans price increase becomes a market indicator but not an instrument. Jeans are

both a market indicator and an instrument.

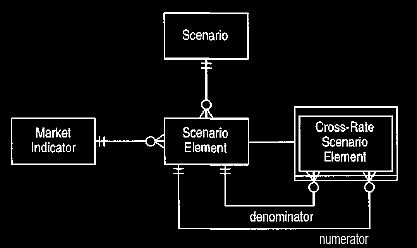

Calculating scenario elements is also straightforward. The key is to accept that

the algorithm for calculating the price can be an object in its own right.

A simple example of this is cross-rates used in foreign exchange. If we know the

exchange rates for USD/DEM and for USD/GBP, then we can calculate the

exchange rate for GBP/DEM as (USD/DEM) / (USD/GBP). We can represent this by

having a cross-rate scenario element, which we model by having a

sub-type of scenario element that references other scenario elements for the

numerator and denominator of the cross-rate, as shown in Figure 19. The

quote for the cross-rate scenario element is then derived from the quotes for

the denominator and numerator scenario elements.

Figure 19 Calculating scenario elements by cross-rates.

This can be used to determine a third element from the ratio of two known

elements.

Note that the denominator and numerator are expressed as scenario elements

rather than market indicators. If we are just expressing cross-rates as

numerator

described above, then referencing the market indicators seems the most sensible

(USD/GBP is a market indicator). However, the whole point of providing

scenarios is to allow us to post several different prices, under different

assumptions, for the same market indicator. Referencing the scenario element

allows us to focus on which of these prices we are to use. There might be two

USD/DEM figures: one from Reuters and one from LIBOR. By referencing the

scenario elements, we are able to indicate which one we want.

Example: A trader is a specialist on the French franc. She determines the

exchange rate between Dutch guilders (NLG) and French francs (FFR) by

cross-rates

using the German mark (DEM). She does this by creating a cross-rate scenario

element. The market indicator for this scenario element is NLG/FFR.

For the numerator she uses the NLG/ DEM rate quoted by Reuters; that is the

scenario element for the instrument NLG/DEM in the Reuters scenario.

However she does not get the DEM/FFR rate for the denominator from Reuters;

instead she uses her own scenario (built on the basis of her own specialized

knowledge).

Thus she forms the cross-rate from scenario elements in different scenarios.

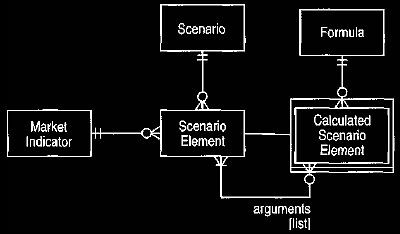

The kind of approach used for cross-rates can be used for a number of common

calculations, where new kinds of calculations are supported by new

sub-types of the scenario element. Figure 20 shows a generalization of this

structure. In this case the calculated scenario element has a list of scenario

elements as arguments and a formula. The formula represents the algorithm for

the calculation, which uses arguments provided to it by the arguments on the

calculated scenario element. For the cross-rate the formula is arg[1] / arg[2].

Figure 20 A more general approach to calculated scenario elements.

The formula can be a spreadsheet-style formula based on the arguments. It

supports a range of arithmetic combinations of scenario element.

The actual arguments are provided by the calculated scenario element. This

allows a single formula to be reused by several calculated scenario elements.

The cross-rate for GBP/DEM uses the formula with arguments <USD/DEM, USD/GBP>,

and the GBP/JPY cross-rate uses the arguments <USD/JPY, USD/GBP>.

Note the importance of providing the arguments as a list rather than the usual

set for multivalued mappings. The position is essential for the formulas to be

correctly written.

Example: The price change for jeans is calculated by a calculated

scenario element that

takes the difference between prices of jeans in this year's scenario and last

year's scenario.

We can implement the formulas in several ways. One way is to hard-code formulas

in the implementation language. Since common formulas (such as

cross-rates) are widely reused, hard-coding is not a disadvantage in this case.

If the number of formulas is small and does not change too often, this is the

best

approach. Even if a new formula is added every month, this would be fairly easy

to control even for a complex system. We can use a more sophisticated

approach if we want to give the user the ability to add formulas. We can build

an interpreter [1] that recognizes a simple range of formulaic expressions. This

technique is familiar to any user who has used spreadsheets. We could provide an

interactive formula builder, but any user who can build a formula can

probably type a spreadsheet-like formula. The interpreter [1] thus does not have

to recognize all possible formulas. It is perfectly all right to have some

formulas built by the parser and some hard-coded. The software for scenario

elements does not care how a formula is built but is concerned with providing

arguments to the formula that generate the calculated quote. Following the best

principles of object-orientation, interface is separated from implementation.

(For further discussion on this

Analysis of Inventory And Accounting,

Section 6)

Modeling Principle: To make a process a feature of a type, the process

must have an abstract interface so that the implementation can easily vary by

subclassing.

A purely hard-coded implementation is one subclass; various parameter driven

approaches are others.

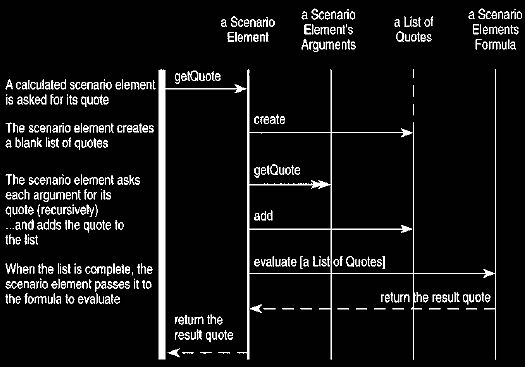

The interaction diagram shown in Figure 21 reveals some useful points about how

this behavior might work. First note how the formula is given a list of

quotes as input, rather than a list of scenario elements. This is mildly

arbitrary, but providing the same thing as input as is returned as output is a

useful policy

to follow. Without this, coders can quickly get confused about the type of

things they are dealing with. This, of course, assumes that the arithmetic

operations are

all defined with a quote, which would be a natural place to deal with two-way

price arithmetic. In this case we can set up the formulas so that they work on

anything that supported arithmetic, not only quotes.

Figure 21 Interaction diagram for calculated scenario elements.

The behavior is naturally recursive in that the getQuote operation calls

getQuote on all the arguments, potentially resulting in a long chain of

calculations.

This, like many recursive structures, is very elegant (but difficult to show on

an interaction diagram). In practice, however, it can lead to quite a

number of redundant calculations. A caching policy for calculated quote values

is needed to prevent unnecessary recalculation caused by repeated calls of

getQuote to the same object. As with any cache, of course, we have to ensure

that the cache is properly updated when a source value changes. We can use the

arguments mapping in the reverse direction to reset all dependent scenario

elements.

Modeling Principle: When information can be retrieved from an

information source or calculated from other available figures, an abstract

interface with sourcing

and calculation as subclasses should be provided.

|