|

Analysis of Inventory and Accounting

See also:

Using the

Accounting Models

A large proportion of commercial computing systems are designed to track the

money moving through an enterprise, recording how it is earned and spent.

The fundamental idea behind accounting and inventory tracking is that there are

various pots of money and goods, and we must record how money and goods

move among these pots.

The inventory and accounting patterns in this analysis are born from this

fundamental idea. They present a core set of concepts that we can use as the

basis

for financial accounting, inventory, or resource management. The patterns do not

describe these processes directly, rather they describe the underlying ideas

from

which processes can be built. Discussion in

Using the

Accounting Models describes a simple example that uses

these ideas for billing telephone calls.

In this analysis we use a simple personal financial example to explain the basic

ideas of accounting and inventory. Although similar, the terms we use are not the

terms traditionally used in financial accounting. In our search for a more

abstract

model, we found that we needed new terms and concepts. A particular feature of the

patterns in this analysis is how the rules for processing are embedded into the

accounts system. This approach allows the accounts to update and manage

themselves. This turns a traditionally passive recording system into an active

system that can be configured by wiring up the accounts in the appropriate

manner.

The first pattern is that of an Account (Section 1). An account holds things of

value - goods or money - which can only be added or removed by entries.

The entries provide a history of all changes to the account. When we use an account

to record the history of changes to a value, it is important to check that items do not get lost.

Transactions (Section 2) add a further degree of auditability by linking

entries

together. In a transaction, the items withdrawn from one account

must be

deposited in another; items cannot be created or destroyed.

There are two kinds of transactions: A two -legged transaction moves an

amount from one account to another. A multi-legged transaction can have entries

in several accounts as long as the transaction as a whole balances.

Accounts can be grouped together using a Summary Account (Section 3), which

applies most of account's reporting behavior to groups of accounts.

Sometimes

we need to make account entries that are not designed to be kept in balance; a

Memo Account (Section 4) deals with this task.

An account can include fixed rules that govern how amounts are transferred

between accounts. Posting Rules (Section 5) allow us to build active networks of

accounts that update each other and reflect business rules. To achieve this,

instances of a posting rule require their own executable methods, a requirement

that introduces the important modeling concept of an Individual Instance Method

(Section 6). Individual instance methods can be implemented with some

combination

of a single sub-type, the strategy pattern, an internal case statement, an

interpreter,

and a parameterized method.

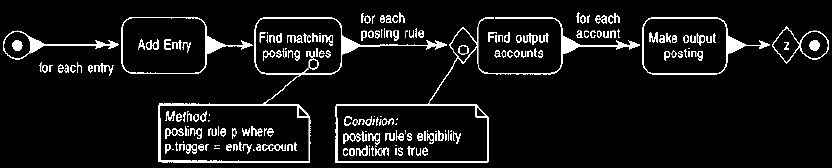

The Posting Rule Execution (Section 7) pattern describes ways in which posting

rules can be triggered: while a transaction is created; by asking an account to

process its rules; by asking a posting rule to fire; or by asking an account to

bring

itself up to date, thus firing its predecessors in a backward chaining manner.

To use posting rules with many accounts, we need a way of defining Posting

Rules for Many Accounts (Section 8). One way is to use a knowledge level, in which

case

posting rules are defined on account types. Another way is to link posting rules

to

summary accounts.

In an accounting system, various objects will want subsets of the account's

entries and their balances, both of which require a pattern for choosing entries

(Section 9). This pattern is useful whenever we want a selection of objects from a

multi-valued mapping. Our alternatives are to return the whole set and let the

client do the selection, adding extra operations to the account, or using an

account

filter.

We can divide large networks of posting rules into groups by using the Accounting

Practice (Section 10) pattern. In long calculations we often need to go

back

to see why various transactions gave the result they did; then we need to use

the

sources of an Entry (Section 11) pattern.

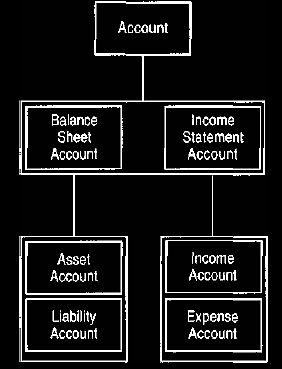

Balance sheets and Income Statements (Section 12) distinguish between accounts

that record items being held and accounts that record where items

come or go.

Different people can have similar views of accounts; for example, our view of

our

bank account is probably similar to our bank's view.

One is a Corresponding Account (Section 13) of the other.

The resulting patterns are quite abstract; particular cases need a Specialized

Account Model (Section 14) to apply them to everyday practice.

Such accounts are

developed by sub-typing the general accounting patterns.

The final pattern in this analysis describes booking entries to Multiple Accounts

(Section 15). This pattern is useful when there is more than one way of

reporting the

trail

of entries. The two alternative techniques are using memo entries or using

derived

accounts. We can use derived accounts instead of

accounting patterns when we

want the reporting behavior of accounts but not the balancing and audit

capabilities.

These models are the results of ideas generated during several projects. They

originated from working on a customer service system for a US utility company,

and were further developed while examining accounting structures for an

international telecommunications company. The models also draw deeply from

the recent development of a payroll system for a major US manufacturing

company.

Key Concepts: Account, Transaction, Entry, Posting Rule

1. Account

In many fields it is important to keep a record of not only the current value of

something but also details of each change that effects that value. A bank

account

needs to record every withdrawal and deposit; an inventory record needs to

record each time items are added or removed.

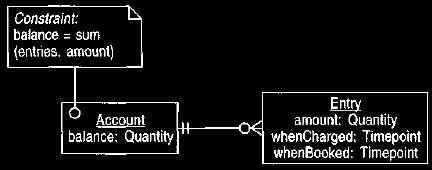

An account is similar to a quantity attribute, with an added entry for every

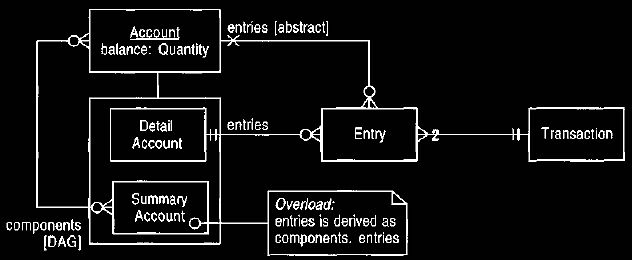

change to its value, as shown in Figure 1. The balance, which represents the

current value of the account, is the net effect of all entries linked to the

account.

This does not mean that the balance needs to be recalculated each time it is

asked

for. Derived values can be cached, although the cache would be invisible to the

account user. By using the entries, a client can also determine the changes over

a

period of time and the total amount of deposits or withdrawals (see Section

9).

The sign on the amount indicates whether the entry is a deposit or a withdrawal.

A statement is a list of all the entries that have been carried out against an

account

over a period of time.

Figure 1. Account and entry.

The entries record each change to the account.

Example: we withdraw $100 from our checking account. This is represented as an

entry with

amount -$100 attached to our checking account.

Example: we buy 4 reams of standard letter paper from a shop. The shop represents

this as an

entry on their standard letter paper account with amount -4 reams.

Example: In January we use 350 KWH of electricity. This is represented as an entry

with

amount 350 KWH to our domestic electricity usage account.

Modeling Principle: To record a history of changes to a value use an account for

that value.

One way an implementation can compute a balance is to take a collection of

entries and form a collection of quantities. Smalltalk has a specific operation,

collect, to do this. The danger is that the collect operation collects the

objects into

the same kind of collection as the original. Thus running collect on a set of

entries

yields a set of quantities. Sets allow no duplicates, so if we have two entries

with

the same amount, only the first entry's quantity is counted, and the balance

value is

incorrect. To form collections of fundamental values, it is often better to use

a bag,

which does allow duplicates. In C++ this problem is less common because collect

operations are less common and more difficult to use; instead C++ users use an

external iterator which does not have this problem. As a check, however,

test

cases should always include entries with equal amounts (as well as entries with

every attribute equal).

Figure 1 indicates two timepoints for the entry: one indicates when the

charge is made and the other when the entry is booked to the account. This is

particularly important when retroactive charges occur. A price for a charge may

have changed between the charge date and the booked date, so both dates are

required. We need to know both the history of events and our knowledge of that

history. Timepoints also include both the time of day as

well

as the date;

many applications are happy with just the date.

Example: we have a meal at Jae's Cafe on April 1. The credit card company receives

notice of

payment on April 4. The entry has a charged date of April 1 and a booked date of

April 4.

2. Transactions

Using entries help keep a record of changes to an account. These changes usually

involve moving an item from one account to another. When we withdraw money

from our bank account, we am adding money to our wallet, or cash account. With

many items it is not enough to just record the comings and goings; we must also

record where they come from and go to.

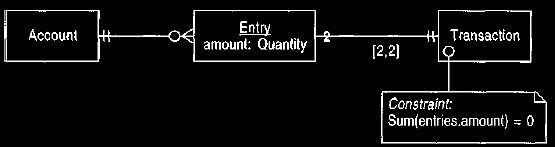

The transaction helps by explicitly linking a withdrawal from one account

to a deposit in another, as shown in Figure 2. The double entry

approach reflects a

very basic accounting principle that money (or anything else

we must account for) is never created or destroyed, it merely moves from one

account to another.

Figure 2 A transaction with two entries.

Example: we use our credit card to pay Boston Airlines $500 for an airline ticket.

This is a

transaction from the credit card account to the Boston Airlines

account with an

amount of

$500. Later we will make a transaction from our checking account to the credit

card account to

bring the credit card

account's balance to zero.

Example: Aroma Coffee Makers (ACM) moves 5 tons of Arabian Mocha from New York to

Boston. This is transaction from the New York account to the Boston

account with

an

amount of 5 tons.

In complex accounting structures we aim to get the accounts to balance— that

is, to reach zero—at various points in the business cycle. By building the

principle

of conservation into the model, we make it easier to find any "leaks" in the

system. Although it's not essential to use transactions when you are using

accounts,

we

prefer to.

Modeling Principle: When working with accounts, follow the principle of

conservation: The

item being accounted for cannot be created or destroyed,

only moved from place

to place.

This makes it easier to find and avoid leaks.

2.1 Multi-legged Transactions

Figure 2 implies that each transaction consists of a single withdrawal and a

single corresponding deposit. In fact we can have many withdrawals and deposits

in a transaction. Say we receive $3000 from Megabank and $2000 from Total

Telecommunications. we decide to deposit both checks into our checking account.

Our bank statement will show a $5000 credit. Note that although two checks have

hit our bank account, a single entry is shown. This transaction is represented by

the multi-legged transaction model shown in Figure 3. The upper bound on the

mapping is lifted from transaction to entry. The overriding rule is that the

entries

must balance with respect to the whole transaction, but no match is required

among individual entries. Thus we can model our bank account situation with a

transaction that consists of three entries: [account:

checking account, amount: $5000], [account: Megabank, amount: ($3000)],

[account: Total Telecommunications,

amount: ($2000)]. The transaction is

responsible for ensuring that money is not created or destroyed.

Figure 3 Multi-legged transactions.

These allow more flexibility in forming transactions than the two-legged model.

Example: Aroma Coffee Makers removes 5 tons of Java from New York and sends 2

tons to

Boston and 3 tons to Washington. This is a single transaction

with three

entries: [account:

New York, -5 tons], [account: Boston, 2 tons], [account: Washington, 3 tons].

The two-legged model is a particular case of the multi-legged model where the

transaction has only two entries. In some applications the two-legged model

predominates, and we have a model similar to Figure 4. Other applications

might have a large number of multi-legged transactions. we would recommend the

multi-legged approach because it provides more flexibility. Two -legged

transactions can easily be created by a special creation operation on a

multi-legged

transaction, which is a useful convenience. The rest of this discussion assumes

the

multi-legged model.

Figure 4 A model of a two-legged transaction that does not use entries.

This model may be found where all the transactions are two-legged. It has much

the same

capabilities as Figure 2. However, we would prefer using Figure 2 since

it is

easier to

migrate to a multi-legged transaction.

The mutual mandatory relationship between transaction and entry introduces

a chicken and egg problem. we cannot create an entry without creating a

transaction

because of a constraint. Similarly we can't create a transaction without an entry

because transaction is similarly constrained.

One solution is to provide a creation operation on transaction that takes a list

of partially defined entries, or even a list of arrays with appropriate

arguments.

Entry would have its creation operation made private but accessible to the

transaction's creation. The transaction's creation would then be the only place

that

could create entries. Obviously, during the execution of this creation

operation,

objects would be in violation of their constraints. The rule with constraints,

however, is that public operations should end with all constraints satisfied.

Providing only the transaction's creation routine is made public, this rule can

be

enforced.

3. Summary Account

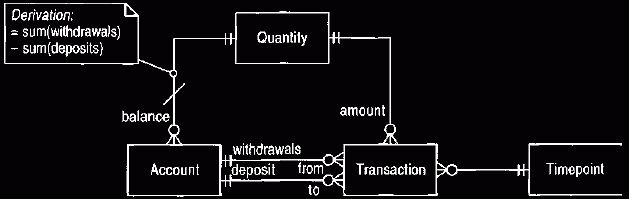

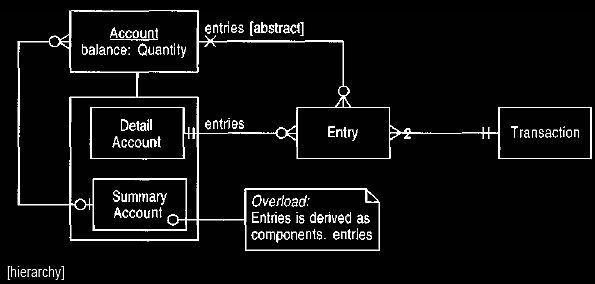

In a system of accounts it is often useful to group accounts together. For

example, we might want to group our Total Telecommunications and Megabank accounts into

a business income account. Similarly we want to put rent and food into personal

expenses and our business travel and office expenses into business expenses. This

kind of structure can be supported with a simple hierarchy of detail and summary

accounts, as shown in Figure 5.

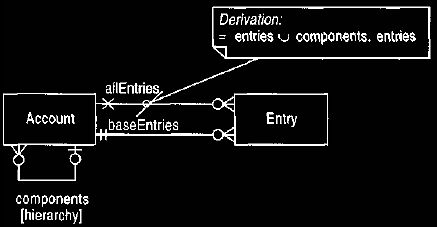

Figure 5 Summary and detail accounts.

A summary account can be composed of both summary and detail accounts. This

forms

a hierarchy, with the detail accounts as leaves (an example of Composite).

The

entries of a summary account are derived from the components' entries in a

recursive

manner.

In this hierarchy structure we can bring together accounts into summary

accounts. We restrict the system to posting entries only to detail accounts and

not

to summary accounts. Summary accounts can still be treated as accounts because

their entries are derived according to their components' entries. A summary

account that contains summary accounts will look for entries in its components,

its

components' components, and so on, recursively. This derivation of the entries

mapping allows us to describe the balance attribute, and any other operations

and

attributes that depend on entries, at the super-type level.

Example: we have a summary account for air travel with detail accounts for

Mega-bank air

travel and Total Telecommunications air travel.

Example: Aroma Coffee Makers has a summary account for Java with detail accounts

for

each warehouse. It can thus find out the total amount of Java that it owns.

Note that the relationship among components needs to be marked to show it

is a hierarchy. The cardinalities are not enough to enforce this constraint. We

must not have cycles in this structure.

The separation between summary and detail accounts is quite common in

accounting, but it is not absolutely necessary. The model in Figure 6 shows

the

distinction removed. In this case an entry can be made to any account, and all

accounts can be placed in a hierarchical structure. This can be done by

providing

two mappings from account to entry: one to show which entries are posted at that

level, and another to add together the entries on sub-accounts. The first would

be

updatable, the latter is derived, not updatable, and used for balance,

statements,

and other features that were on the super-type in the Figure 5 model.

Figure 6. Account hierarchies without separating summary and detail accounts.

We

can use this model to post entries to summary accounts.

So far we have followed conventions that say that accounts must be arranged

in a hierarchy and that entries are booked to only one account. We will continue

with these assumptions for a while, but we will consider some alternative

possibilities later on in Section 15.

4. Memo Account

Benjamin Franklin once said, "In this world nothing can be said to be certain,

except death and taxes." We can't eliminate the pain of paying taxes, but

we find

the

pain is lessened somewhat by avoiding surprises on our tax return. Each time we

earn some money, we allocate a portion to a tax liability account. we then know

how

much of our money is really mine, and how much we owe in taxes.

Notice that with this plan, no real money has moved. There is no payment

from our checking account until we have to pay the tax. Furthermore, our tax

category lumps together state and federal taxes. When we actually pay (and when

we

pay estimates], we will make transactions from our checking account to the

accounts federal tax and state tax. When we do this we need to reduce our tax

liability

account by the same amounts, but again no money moves between the real

accounts (checking account, federal tax, state tax) and this tax liability

account.

This account acts as a memo to us on how much money we owe in taxes, thus it is

referred to as a memo account.

A memo account contains amounts of money but not real money. It is

important that no real money leaks from or to a memo account. So in our tax

example, as we take the money from our income account to our checking account we

make an entry at the same time into our tax liability memo account. Memo

account becomes another sub-type of account, and we have to ensure that

transactions do not shift money between that and the other accounts. This can be

done by ensuring that the balance constraint on transaction excludes memo

accounts.

If we are using transactions, we need to ensure that we always move money

between accounts and that we do not create or destroy money. This implies that

when an entry is made to the tax liability account, a balancing entry is made

somewhere. Since it can be difficult to see what account would be a sensible

host

to this entry, accountants frequently create a contra account. Thus the tax

liability

account would have a contra tax liability account, which acts as the other end

of all

entries in the tax liability account, either withdrawals or deposits. This

approach

can be used with the usual model, but it is not strictly necessary. If the

balance

checking constraint ignores memo accounts, then single-sided entries against

them are allowed. A contra account can always be generated automatically. This

approach would imply that the lower bound on the mapping from transaction to

entry can be reduced to 1.

Example: Each time we receive a payment from a client, we record it as a

transaction from a

client income account to our checking account. We also enter a portion

of that

amount into the

tax liability memo account. When the time comes to pay estimated taxes, we make a

transaction from our checking account to our

federal tax account. We add a third

entry to this

transaction to reduce the amount on our tax liability memo account by the same

amount.

Of course, if we don't use transactions, we don't run into any balance

problems and can post the entries without worry, but the danger is that real

money can leak into memo accounts (or into thin air) more easily.

5. Posting Rules

Using a memo account we can make a posting to a tax liability account, but we

still

have to remember to do it. Since we always enter 45 percent of each fee income

entry into a memo tax liability account, a computer system should be able to do

it

for us automatically.

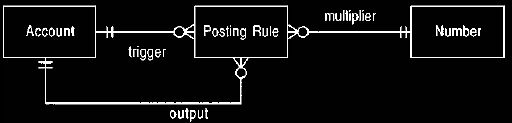

What is needed is a rule that looks at a particular account and, when it sees an

entry, creates another entry. A simple example of this kind of rule is shown in

Figure 7. A posting rule is described by specifying an account as a trigger.

Any

entry in the trigger account causes a new entry to be made, which is the value

of

the original entry multiplied by the multiplier.

Figure 7 A simple structure for posting rules that multiply by a factor.

For each entry in the trigger account, we post an entry to the output account of

the value

of the triggering entry multiplied by the multiplier.

Example: Our tax liability can be handled by a posting rule with the fee income

account as

the trigger, the tax liability account as the output and the multiplier as 0.45.

Multiplication by a scalar handles a number of useful situations for a posting

rule, but the process can easily get complex. Consider a graduated income tax:

The first £300 carries no tax, the next £2500 carries a 20 percent tax, the rest

is at

40 percent. A simple scalar multiplier is no longer enough. We want posting

rules

to carry any arbitrary algorithm, which would give us the maximum flexibility.

To give posting rules this flexibility, we have to link a calculation to each

instance of a posting rule, since every rule will have a different way of

calculating

the amount of the new entry. Conceptually this means that each instance of a

posting rule needs to have its own method for doing the calculation, as shown in

Figure 8. The glib notation masks a significant problem. Mainstream object

systems allow behavior to vary by polymorphism and inheritance, but this is

class

based: The behavior varies with the object's class. We want the behavior to vary

with each individual instance, which requires the individual instance methods

pattern, as discussed in Section 6. (We discuss a similar problem in

Analysis of Exchange Trading, Section 2.)

Figure 8 Posting rules with methods to calculate values for entries.

This notation says that each instance of a posting rule has its own calculation

method.

5.1 Reversibility

An important property of posting rules is that they must be reversible. Usually

we

cannot delete an incorrect entry because either it has led to an entry that is

part of a

payment or it appears on a bill. The only way we can remove its effects is by

entering a reversal, which is an identical but opposite entry. Thus any posting

rule

must ensure that two entries that are identical but of opposite signs are both

placed

in the trigger account and completely cancel each other out in further

processing.

We can test the reversal by inserting such opposite pairs in routines for a

posting

rule and ensuring their output amounts are also equal and opposite.

5.2 Abandoning Transactions

In some accounts almost all transactions are generated from posting rules. Input

accounts are used to record initial entries from the outside world. All further

account entries are generated by posting rules. The risk of not using

transactions is

reduced because all entries are predictable from the initial entries and the

posting

rules. The responsibility to check that nothing leaks out is transferred from

the

operational use of the system to the design of the posting rules. If we remove

transactions, then it is still valuable to keep a note of the cause and effect

trail

between entries. On the whole we prefer keeping transactions because they make

auditing easier for a small price in overhead. If you don't use transactions,

you

will still need some audit mechanism.

6. Individual Instance Method

A conceptual model should represent a situation as naturally as possible for the

convenience of the domain expert. We should minimize dependencies on a

particular implementation environment as much as possible. Computer design

should reflect human thinking, not the other way round. This philosophy is

reflected in the diagram shown in Figure 8. After defining this conceptual

modeling construct, we need to invent a general way of implementing it. Hence

the question is not "How do we put calculations on individual posting rules?"

but

"How do we attach methods to instances?" This follows the transformational

approach. We want several ways of implementing the

model in Figure 9 behind a single interface. This follows the overriding

principle of template-based design.

The model should define the interface of the

classes. We should be able to exchange the implementations without altering the

interface.

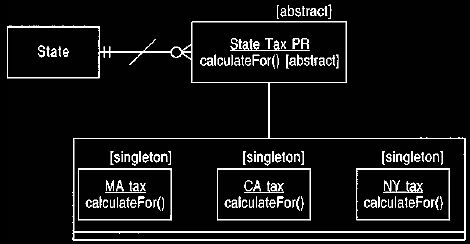

Figure 9 Using singleton classes to implement individual instance methods.

6.1 Implementation with a Singleton Class

The natural way to vary behavior is to use a polymorphic operation based on

subclassing. The simplest way to do this is to subclass the posting rule for

each

instance of the posting rule, thus creating a number of singleton classes. Here

all

the standard methods and properties for posting rules are held by the posting

rule,

and the sub-types merely implement the different CalculateFor methods.

The main problem with this approach is that the sub-types are rather artificial.

They only exist because of the fact we cannot vary CalculateValue by instance.

This artificiality makes the approach less than perfect. Another problem is that

this approach leads to many classes, which makes some people feel rather

uncomfortable. Classes do not present a particularly large

problem because the classes are both small and very constrained. Calculation

methods can be sharedby manipulating the class hierarchy. However, the process

operation on the posting rule can also be the victim of polymorphism, and the

two

polymorphisms

may not match.

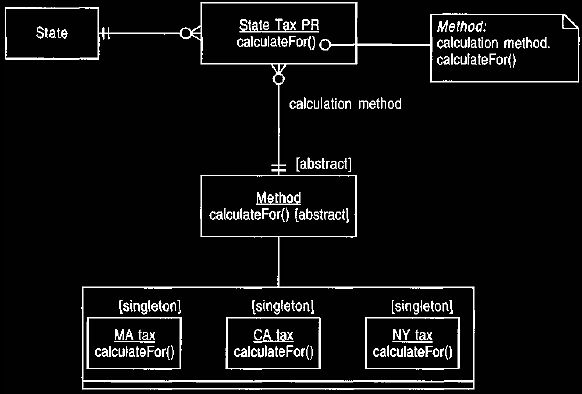

6.2 Implementation with the Strategy Pattern

On first sight the Strategy pattern implementation shown in

Figure 10

looks very similar to the pattern using singletons. The main difference is that

Figure 10 performs sub-typing on a separate method, or strategy, object. The

posting rule is simpler because the whole issue of method choice is eliminated.

The posting rule just knows it can ask a method object to do the calculation.

Figure 10 Using the strategy pattern [1] implementation for individual

instance

methods.

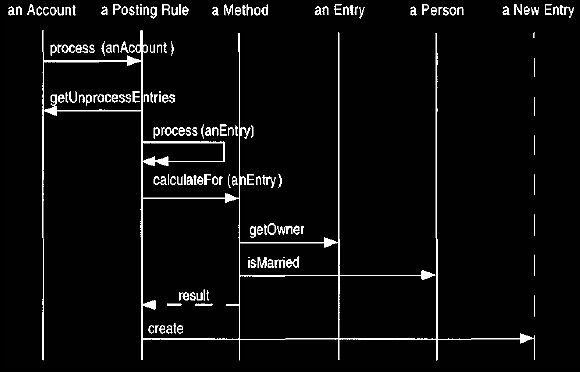

Figure 11 shows the interactions that occur in an example case. An account

asks a process rule to process it. The process rule gets all the entries that

have not

been processed by this rule (see Section 7.2). For each of these entries, it

calls

its method to calculate the value of the new entry. The method may need to ask

questions; for example, tax rates often vary depending on whether a person is

married or not. It passes the result back to the posting rule, which then

creates the

new entry.

Figure 11 Interaction diagram for using the strategy pattern.

The method gets any information it needs by asking the supplied entry.

It should be stressed that this method object is not a "free subroutine," in the

manner of functional designs (or some OO approaches). The method is

encapsulated within the posting rule, since only the posting rule can reference

and

use it.

Posting rule methods can be shared between objects. An example of such a

method is the flat tax method, which applies a flat rate of tax with some

standard

deductions. If the method is the same for several kinds of taxes, with only the

rate

of tax varying, then a method can be designed that asks the posting rule for its

flat

rate but otherwise allows the processing to be reused. This method can be seen

as

a cross between the method object and the parameterized method (see Section

6.4) implementations.

A variation on this approach in Smalltalk is to use a block as the method. By

doing this we eliminate the need for a new method class and eliminate the method

class' subclasses. Blocks are elegant to use but can be very tricky to debug: If

an

error occurs in the block's code, it can be difficult to follow what is going

on. If the

block is simple, however, this approach can work very well.

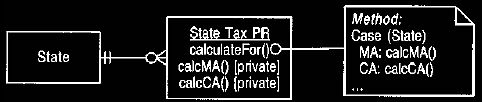

6.3 Implementation with an Internal Case Statement

Faced with creating subclasses just to handle one polymorphic method, we might

wonder why we should bother. Instead we can have a series of private operations

for the posting rule: ComputeFederalTax, ComputeMassTax,

ComputeSalesCommision, and so on. Then a single ComputeFor on the posting rule

has a simple case statement that chooses which private method to use depending

on which instance is the receiver, as shown in Figure 12.

Figure 12 Using an internal case statement for an individual instance method.

This is not a violation of object-oriented principles as long as the case

statement is

encapsulated within the posting rule.

Object designers tend to recoil at the idea of using case statements like this,

but in this situation there is a lot to be said for it. Modifying this

implementation

means adding a new private operation and adding a clause to a case statement.

This is not much different from the new subclasses required with the strategy or

singleton implementation. If the number of methods is large, then we have a

large

(but simple) case statement, or a large number of subclasses. Thus it is a

trade-off

between managing a lot of singleton classes and having to change the case

statement with each new posting rule.

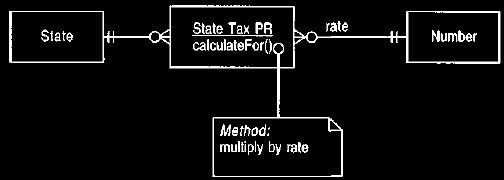

6.4 Implementation with a Parameterized Method

The parameterized method strategy uses a single method in the posting rule and

handles the different behavior by using conditions based on properties of the

posting rule, or of related classes. For example, if all the entries are a flat

percentage, then the posting rule can hold the percentage, and a single method

that

deducts that percentage is sufficient, as shown in Figure 13.

Figure 13 Using a parameterized posting rule.

If some posting

rules have different percentages for married and single people,

then a married and single rate can be held in the posting rule, and the method

asks

the employee for marital status and then uses the appropriate rate.

This strategy works if all the variations in the calculation can be captured by

varying a few parameters. In such cases, however, we must model it that way.

Individual instance methods are only present if the situation is more

complicated

than that. This is a potential implementation because in some cases we can

combine parameterization with another technique.

6.5 Implementation with an Interpreter

If the method is simple, then we can hold the method as a string in a simple

language and build an interpreter for it. Each instance of the method holds its

particular string and the method class can interpret the string (perhaps using

the Interpreter pattern).

Good candidates for this implementation are methods that use simple formulas

that use the arithmetic operators, parentheses, and a couple of simple

functions. If

the language is simple, it is not too difficult to build the interpreter. The

only

limitation is what can be expressed in the language.

6.6 Choosing an Implementation

All of the implementations work well and can be hidden behind a single

operation. We use a parameterized method if we can. Our next choice is to use the

parameterized method implementation in conjunction with one of the other

patterns to see if we can find a blend that uses only a few variant methods to

handle

the larger variations and many parameters to handle the smaller variations. If

only

a few variant methods are needed, then either singletons or an internal case

statement works well. If there are many variants, then the strategy pattern is

the

best. On the whole the strategy pattern is never much worse than singletons or

internal case statements, but it may be a little bit more difficult to

understand at

first sight. If the method can be expressed with a simple language, such as an

arithmetic formula, then the interpreter is a good idea. As the "Gang of Four"

patterns become more widespread, a combination of the strategy pattern and a

parameterized method will become the dominant choice.

All four of the above strategies show ways in which the problem of individual

instance methods can be handled. We can say that the model shown in Figure 8

is the analysis statement of specification, and the designers can choose

whichever strategy is the best for the implementation conditions. This works as

long as a common interface exists for each strategy. The principle of one

analysis

model defining a single interface that can be implemented in many ways is the

foundation of the approach of using design templates for development.

Many modelers would prefer another way of modeling the problem than that

shown in Figure 8. They might prefer an expression closer to one of the other

strategies. They can still make the separation of analysis from implementation

if

they substitute another implementation behind the same interface. Other

modelers would prefer to model in the same form as the implementation. In this

situation they are trading off implementation independence for a greater

seamlessness between analysis model and implementation.

This illustrates clearly the difficulty in drawing a line between analysis and

design. Just as various combinations of classes may satisfy a particular

interface

in software, we may use different combinations of types to model the same

situation in conceptual models. The choice of types can influence the choice of

classes. The overriding influence is that the choice of types defines the

interface

of classes, but what lies behind that interface need not match the conceptual

picture.

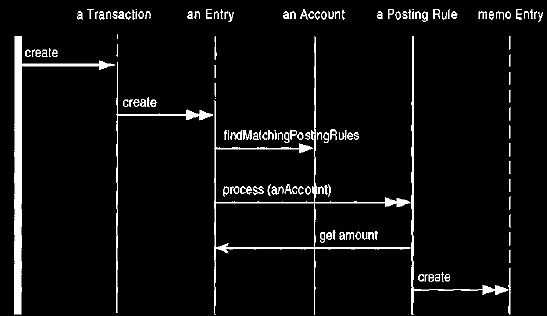

7. Posting Rule Execution

So far we have looked at how a posting rule is structured and how it responds to

being fired, that is, told to execute. This is a good point to step back and

look at

some of the strategies we can use to fire posting rules. The first point we want

to

stress is that posting rules should be designed in such a way that they can be

fired

by different approaches. It is important to separate the strategy of firing the

posting rules from the rules themselves as much as possible to reduce the

coupling

between these mechanisms.

7.1 Eager Firing

In this approach posting rules are fired as soon as a suitable entry is made in

a

trigger account. There are two ways we can do this. One is to put the

responsibility in the transaction or entry creation methods, as shown in Figure

14. Creating a transaction leads to several entries being posted to accounts.

Each posting of an entry prompts a search for posting rules that are using that

account as a trigger. Each of these posting rules is then fired.

Figure 14 Event diagram showing how transaction creation can trigger posting

rules.

The finding and firing of posting rules can be done either during transaction

creation or in the individual entry creation methods, as shown in Figure 15.

The

latter is a better factoring of the process.

Figure 15. Interaction diagram for firing posting rules within entry creation.

A second approach is to make posting rules observers of their trigger account. When a posting rule is set up, it registers itself to the trigger account.

When an

entry is attached to an account, the account broadcasts to all observers that a

noteworthy event has occurred. The posting rule then interrogates the account to

find out what has happened and discovers the new entry. It then generates the

appropriate new entry to the memo account. The advantage of this scheme is that

the transaction no longer needs to activate the posting rule. The observer is a

very

useful mechanism, but we tend to use it only when there is a need to ensure that

visibilities run solely from the observer to the observed, particularly when

they lie

in different packages. We don't like to use observers when we don't need to,

because

too many of them make debugging difficult. We don't think we would put the posting

rules in a separate package so there is no need to use the observer.

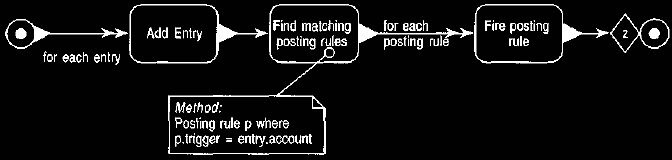

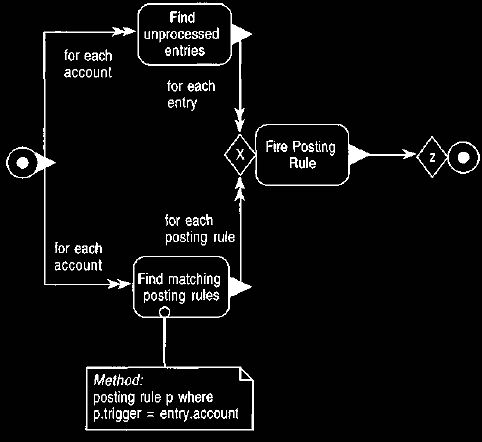

7.2 Account-based Firing

Account-based firing moves the responsibility of firing from transactions to the

account. Entries can be added to an account without any posting rules being

fired.

At some point the account is told to process itself and then fires its outbound

posting rules for all entries that have arrived since the last time it processed

itself,

as shown in Figure 16.

Figure 16. Cyclic firing of accounts.

The X notation indicates that the fire posting rule operation is executed for

each

combination of posting rule and unprocessed entry.

Account-based firing requires the account to keep track of which entries have

not been processed yet. It can do this by maintaining a separate collection for

unprocessed entries (keeping its entries in a list and keeping track of the last

entry

to be processed), or by recording the timepoint of the last process and

returning

entries that were booked after that time (using the when booked property).

Account-based firing can be used in a cyclic accounting system, where

accounts are processed once a day. In this case you must be careful that the

accounts are processed in the right order. Accounts must be processed before any

accounts that may be affected by their outbound process rules. These

dependencies can be determined automatically by looking at the process rules.

7.3 Posting-rule-based Firing

In posting-rule-based firing the posting rule is explicitly told to execute by

some

external agent. It looks at its inputs to find what new entries have appeared.

As

such, posting-rule-based firing is similar to account-based firing,

with many of the same advantages and disadvantages. The main difference is that

since an account can have many posting rules, the responsibility for deciding

which entries have not been processed passes from the account to the posting

rule.

This usually makes the situation more complicated, so we prefer account-based

firing.

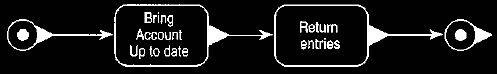

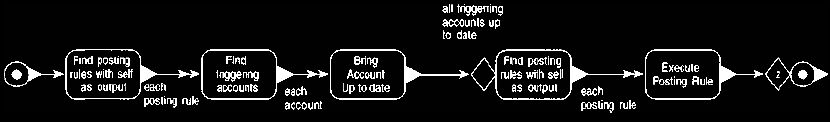

7.4 Backward-chained Firing

Backward-chained firing is a variant on account-based firing: The accounts do

not just process themselves, and they cause all accounts that they are dependent

on to process themselves. With this approach we can discover the up-to-date

status of any account.

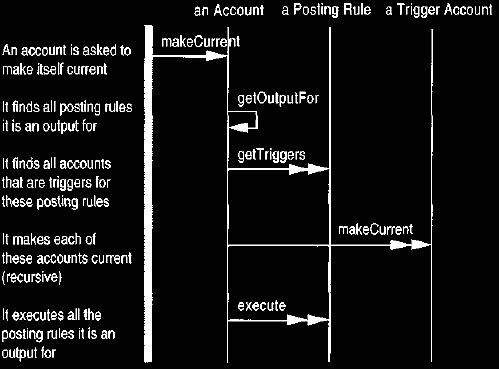

We can start this process by asking an account for its entries, as shown in

Figure 17. The account first brings itself up to date. The account uses the

posting rules to determine which accounts are triggers for a posting rule that

has

itself as an output. These accounts are asked to bring themselves up to date,

which is a recursive process, as shown in Figures 18 and 19. The whole

account graph is brought up to date by simply asking an account at the end to be

processed.

Figure 17. Requesting a detail account for its entries with backward-chained

firing.

Figure 18. Method for bringing an account up to date.

The bring account up to date operation is called recursively on each account

that is an input

for the processing account.

7.5 Comparing the Firing Approaches

The primary considerations in choosing a firing approach is the time taken in

executing the posting rule (an implementation decision) and the point at which

we

want to catch errors. Eager firing allows us to get errors as soon as they are

found.

This gives us more time to find the cause of the errors. It does force us to do

all the

calculations when we are making entries. Account-based and backward-chained

firing give us more flexibility in the timing of calculations. If we process

accounts

in a batch method, we can read all the entries from a file and then fire the

posting rules at our leisure, perhaps overnight.

The sooner we fire, the sooner we will find any mistakes.

Figure 19. Interaction diagram for bringing an account up to date for

account-based firing.

Choosing between account-based and backward-chained firing is really

about whether we want to handle the extra complexity of building

backward-chained firing. Backward chaining is more awkward to build than

account-based, but once built it is easier to use. Thus we would use

account-based

for simple account structures and backward-chained for complex account

structures. On the whole we don't like eager firing because it is not as

flexible.

We can get all the benefits of eager firing by ensuring that posting rules are

fired as soon as we

add entries (but not as part of entry creation).

Although this is an extra step,

it

does allow us to choose not to do so if we wish. Eager firing does not give us

that

choice. If we have so much processing power

that the posting rules do not cost

anything, then it makes no difference.

There is no reason why you cannot mix the firing approaches. Income

accounts might use eager firing into a couple of layers of asset accounts and

then

use backward chaining for the rest of the way. Using more than one firing scheme

will make the system more complex and confusing, however, so we don't mix them

unless we have a good reason.

This kind of approach is still new, and we are still learning about the

trade-offs inherent in the various firing schemes. Since this is such a fluid

area, it

is important to retain flexibility so that you can change the firing scheme as

you

watch the system in action.

8. Posting Rules for Many Accounts

So far we have considered the parochial example of myself and

our own chart of

accounts. We need to extend this to handle many people. We want the posting

rules to be consistent, so that a single federal tax posting rule can be used to

determine federal tax liability for all the people involved.

With this extension there is no longer a posting rule operating over a single

account. Each employee needs a unique account, yet the federal tax liability

posting rule should be programmed to work for all employees. We do not want to

have to make a separate posting rule for each employee.

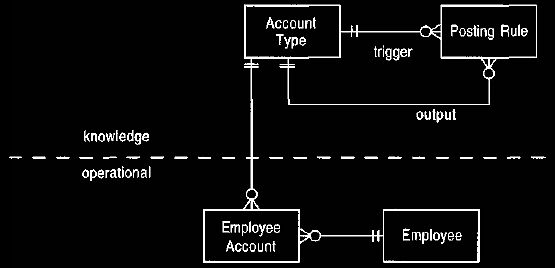

There are two ways we can do this. The first is to use the notion of knowledge

and operational levels (see

Analysis of Corporate Structure, Section 5).

We set up the posting rules at the

knowledge level and link them to account types, as shown in Figure 20. Thus we

would have account types for fee income,

pretax earnings, net earnings, and so

on.

Entries that appear in accounts check the posting rules on their account type,

effectively adding a level of indirection

to the kinds of expression discussed

above.

Figure 20. Using account types.

This introduces a knowledge level on which the posting rules can be defined.

Example: All employees accrue 1 day of holiday for every 18 days worked. This

could be

represented as a posting rule with a trigger of the account type days worked and

an output

of the account type accrued holiday. This method ensures that the accrued

holidays account

balance was 1/18 of the days worked balance.

Each time the employee account is

triggered, it

looks for posting rules defined on its account type according to the type of

triggering being

used.

However a knowledge/operational split, although appealing, is not the only

way of handling this situation. A second approach is to use summary

accounts. A posting rule defined on a summary account is activated when any

entry is placed into any subsidiary of the summary account (or the account

itself,

if summary account posting is allowed). The output account can similarly be

defined on a summary account with the interpretation that this will cause an

entry

on the appropriate subsidiary account.

Example: In this case there are summary accounts for days worked and accrued

holiday.

The posting rule is the same as the example above. Instead of checking

the

account type for

posting rules, the summary accounts are checked.

The choice between the two methods depends on the degree of difference

between account and account type. If all posting rules are defined on account

type

and entries are made on accounts, then the knowledge/operational split is

reasonable. However, sometimes this situation does not occur. Entries can be

made at the more general level, perhaps to indicate a general fee to the company

(which would require the model shown in Figure 6). Similarly, posting rules

might vary with each individual payment: This would be required to support

deductions for a car loan, for example. When such situations occur, it is better

not

to make the split.

There is no generally correct approach to take. In any given situation it is

necessary to see which model provides the best fit. The key factor is the degree

of

difference in the behavior of the candidate accounts and account types.

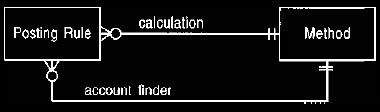

In either case the posting rule needs to determine how to make the correct

output entry. In many of the examples above, the posting rule simply looks for

the

account for the same employee as the triggering entry. More complex situations

are possible, however. Consider a situation where a fee entry to a junior

consultant

causes a percentage of the fee to be posted in a memo account for that

consultant's

manager. In this case the posting rule needs to be told how to find the lucky

manager.

Figure 21. Using an account finding method.

Separate methods are used for finding output accounts and calculating the value

of the

transaction.

One way of handling this is to provide a second method to find the appropriate

output account, as shown in Figure 21. This second method asks the originating

entry for its employee and then that employee for its manager.

This provides the greatest degree of flexibility, at the cost of a second method

object,

which must be implemented as suggested in Section 6.

This hints at another problem. With general posting rules not all employees

may be eligible for the posting rule to fire. For example, posting rules can be

set

up to handle each state tax. A posting rule for Illinois state tax should only

fire,

however, if the employee is a resident of Illinois. Thus suggests a third

method,

which is used to express the eligibility condition, as shown in Figures 22 and

23.

Figure 22. Event diagram showing the use of account finder and eligibility

condition methods added to Figure 14.

Figure 23. Adding an eligibility condition to the above rules.

In many situations a posting rule needs to select some subset of entries from

its

trigger account. It may want to look at all entries since a certain date booked,

the

balance of all entries charged in July, or entries of dangerous goods (which

would

use some sub-type of entry). There are three ways of performing selections:

getting

all entries back and then doing a selection, providing a selection-specific

method,

and using a filter.

The first technique is the simplest: The account returns all the entries, and

the

client processes this collection to select the entries it needs. This requires

no

additional behavior on the account but passes all responsibility to the client.

If

many clients need to carry out similar selections, a lot of duplication can

occur.

If

there are many entries, there may well be an overhead in

passing the set out, especially if the set needs to be copied. Remember that an account should never

pass out an unprotected reference to its own way of storing

entries (see Section 14.1). Using this approach with entries also means that the

client is responsible for summing the entries to get a balance.

If many clients are asking for a similar kind of selection, such as entries in a

time period, then an additional behavior can be added to the account to satisfy

this (such as EntriesChargedDuring (TimePeriod)). This has the advantage of

saving all the clients from repeatedly going through the same selection process.

We

can save the clients even more effort by providing a method that gives a balance

over a time period (such as BalanceChargedDuring (TimePeriod)). The

problem

with this solution is that if there are many such selections, the

account

interface grows very large.

A filter (see Analysis of Exchange Trading, Section 2) is an object that encapsulates a query. Using that

pattern here would result in an account filter. An account filter

includes

various

operations to set the terms of the query. Once the filter is set up, it is

applied to

the account to get the answer, as shown in Figure 24.

The account uses the

filter to select the subset of entries by conceptually taking each of its

entries and

testing it with the filter's IsIncluded method.

It may apply its private

knowledge

of how the entries are stored to optimize this process. With this approach the

account can support most selections of entries

with EntriesUsing

(AccountFilter) and give corresponding balances with BalanceUsing

(anAccountFilter). Note that if sub-types of entries have additional features

that are

used as a basis for selection, then sub-types of account filter may be needed for

each type of entry.

With a multi-valued association we start by returning all the objects and leave it

up to the client to select them. If there are a few frequently used selections,

we

might consider using an additional behavior, but only for a few behaviors. If a

selection results in too much duplication to return all the objects, but there

are

too many behaviors to add, we set up a filter. Setting up and maintaining a

filter

does require extra work, so we use it only when we really need it. This need often

appears with accounts and their entries.

10. Accounting Practice

When we run into a large network of accounts with many posting rules, the

network becomes too big to deal with. In this situation we need some way to

break down the network into pieces. Consider a utility's billing procedures.

They

bill the various types of customers they have with different billing processes.

This

can be represented as a network of accounts. Each type of customer has different

rules and can be handled with a slightly different network of accounts.

Figure 24. Interaction diagram for using an account filter.

A particular network of accounts is an accounting practice. Conceptually an

accounting practice is simply a collection of posting rules, as shown in Figure

25.

The notion is that each type of customer is assigned an accounting

practice

to handle billing.

Figure 25. Accounting practice.

These are used to group posting rules into logical groups.

Example: A power utility divides its residential customers into regular and

lifeline categories.

The lifeline category is for those who the state deems need

to be charged

minimum rates.

The regular customers are divided into three different rate schedules depending

on the

area in which they live. This is handledby four accounting practices: one for

lifeline and one

for each of the three areas.

Example: ACM has many union workers and each union negotiates a different deal.

ACM

has a pay practice for each union.

The same posting rule can exist in more than one practice. This is often the

case when similar behavior is needed across practices. We need to be aware of

the

difference between copying a rule from one practice (leading to two identical

rules)

and having the same rule in more than one practice. Having a rule in more

than

one

accounting practice implies that when the

rule is changed it changes for all practices that use it. Copies allow one copy

to

change without the others changing.

Accounting practices are assigned to some user object so that each user has a

single accounting practice. Thus each customer of a power utility or employee of

a

company uses a particular accounting practice. This assignment can be done

manually or a rule can determine it.

Example: In ACM the pay practice is assigned to a worker based on his union.

Instead of using an accounting practice, you can use a posting rule that

divides up entries depending on an attribute of the employee. Instead of using

one

practice for each union, you can use only one practice. The first posting rule

looks

at the union of the employee that the entry is made for and makes an entry for

the

appropriate union account (see Section 7.6 for an example of this kind of split

posting rule).

We prefer to use separate practices if the problem is at all complex, providing

that we can assign a practice to a user for a period of time. Any splits that

always

change on an entry-by-entry basis (such as the evening/day split discussed in

Section 7.6) must have a posting rule to handle them. If a user changes its

accounting practice, we can use a historic mapping to keep a

record of these changes.

When different stages of processing have logically separate clumps of

posting rules, we can split the rules up into different practice types and give

a user

a practice from each type. In Figure 26 an accounting practice can have users

that can, in general, be any object. In a particular model, of course, users

would be

customers, employees, or the like. Each user has one accounting practice of each

type, a constraint that is enforced by the keyed mapping.

Figure 26. Accounting practice type.

In larger account networks we define a configuration of accounting practices

that vary

for each object that uses them.

Example: A utility has several practices for billing its residential customers,

but all residential

customers are taxed the same way. We can handle this by

having separate charging

and

taxing practices. All residential customers have the same taxing practice,

although they

have separate charging practices.

A logical conclusion to this discussion is to treat accounting practices and

posting rules as parts of the same composite [1]. This allows composition of

practices for many levels. So far we haven't seen a great need for this, so we

have not

explored it further.

11. Sources of an Entry

It is often important to know why a particular entry is in the form it is. For

example,

if a customer calls to ask about a particular entry, the current model

can give

us

quite a lot of information about how the entry was created. We can determine the

state of the account at that time by looking at the dates of

other entries. We

can

also determine which posting rule calculated the entry. The model shown in

Figure 27 can handle such customer requests by getting

each transaction to

remember which posting rule created it and which entries were used as input for

the transaction.(If you are not using transactions, the association runs from

entry

to entry.)

Example: we received $2000 for some work for ACM, which we recorded as a

transaction from

fee income to checking account. Our posting rule created a

separate transaction

into our tax

liability account. The creator of this transaction was the 45 percent posting

rule, and the

sources for this transaction contained

the withdrawal from the fees income

account.

Figure 27. Sources for a transaction.

This records a full trail of calculations for each entry in both directions.

Using this pattern, we can form a chain of entries and transactions across the

accounting structure. Each entry can determine all the causes and effects by

recursive use of the sources and consequences mappings.

Modeling Principle: To know why a calculation came out the way it did, represent

the

result of the calculation as an object that remembers the calculation

that

created it and the

input values used.

12. Balance Sheet and Income Statement

When using accounts to describe a system, it can be worth distinguishing between

the balance sheet and income statement accounts, as shown in Figure 28.

Our

checking account is an asset account, and our credit card account is a liability

account. They reflect the money we have (or in the credit card's case, don't

have)

at

any period of time. These appear on our balance sheet. Income and expense

accounts reflect where money comes from or goes to. We have an income account

for our employer, another income account for interest from our savings, an expense

account for traveling, another for food, and so on. The balances of our income

and

expense accounts do not reflect any money we currently have, merely our

classification of where it comes from and goes to.

Figure 28 Asset, income, and expense accounts.

These are the kinds of accounts usually found in financial accounting. The

concepts are

useful elsewhere to distinguish between things held and the classification

of

where they

come from and go to.

Accounts are generally used in a pattern where items enter the world via an

income account, pass through several asset accounts, and are disposed of via an

expense account. Any assets that are saved by the system are kept in particular

asset

accounts, but many asset accounts are merely staging places intended

to be

balance

regularly. Liability accounts are almost always intended to balanced at some

point

(which may be far in the future for a long-term debt

such as a mortgage).

Example: we buy a ticket from Boston Airlines with our credit card. Our credit

account is a

liability account, and the Boston Airlines account is an expense account.

Both

accounts are

classified by us, and we are the owner of the credit card account (it is our

liability).

Example: ACM buys 3 tons of Java from Indonesian Coffee Importers. ACM has an

income

account for Indonesian Coffee Importers to record the transfer of the

3 tons of

Java from

Indonesian Coffee Importers to ACM's New York account. The New York account is

an asset

account, owned by ACM.

At this point we can quickly explain why we have avoided the terms debit and

credit. These are well-known terms that apply to accounts, yet we have ignored

them in favor of from, to, deposit, and withdrawal. The reason is that debit and

credit are not used consistently in the sense of deposit and withdrawal. For

income

statement accounts, credits increase an account and debits decrease it, which

makes sense for the layperson. For balance sheet accounts, however, debits

increase assets (that is, they are deposits), and credits decrease assets. This

may

seem strange to non-accountants, but it is the usual accounting convention.

We

have

thus avoided debit and credit, partly because they might confuse any

non-accountant readers, and partly because we are working with a more abstract

model than regular financial accounting.

13. Corresponding Account

Although income and expense accounts are external —the money is not

mine—they are our accounts in that we choose the classification. The bank's view

of accounts illustrates this. We have a checking account that is an asset within

our

personal system of accounts. The bank has an account within its system of

accounts that looks remarkably similar. The bank is the classifier of the bank's

account, but we own the assets within it. We could consider this the same account

as the one in our system of accounts, but this would not work. We might post an

entry for an ATM withdrawal on March 1, which is the day we made the

withdrawal. The bank posts the same withdrawal on March 2 because that is the

next working day at the bank. The two accounts both refer to the same asset, but

they are not the same because their entries differ. It is better practice to

consider

the two accounts as corresponding.

Corresponding accounts are expected to match in some way and are usually

reconciled at some point. This is what happens when we match our checkbook (our

account) against the bank statement (the bank's account). The reconciliation

process may be precise, or it may allow some imprecision, such as slight

differences in dates.

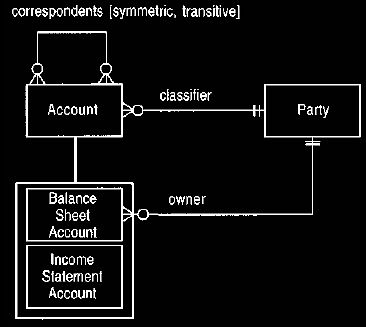

Figure 29 illustrates this situation. Only balance accounts have owners;

income statement accounts do not have assets so there is no question of

ownership.

All accounts have a classifier to indicate who creates and manipulates the

accounts; we have used party (see Section 2.1). The correspondents relationship

shows a couple of special properties: symmetry and transitivity. First it is

symmetric: If account x is a correspondent of account y then account y must be a

correspondent of account x. The usual default for associations is that they are

asymmetric. Transitivity indicates that if account y is a correspondent of

account

x and account z is a correspondent of account y, then account z is a

correspondent

of account x.

Figure 29. Corresponding accounts.

14. Specialized Account Model

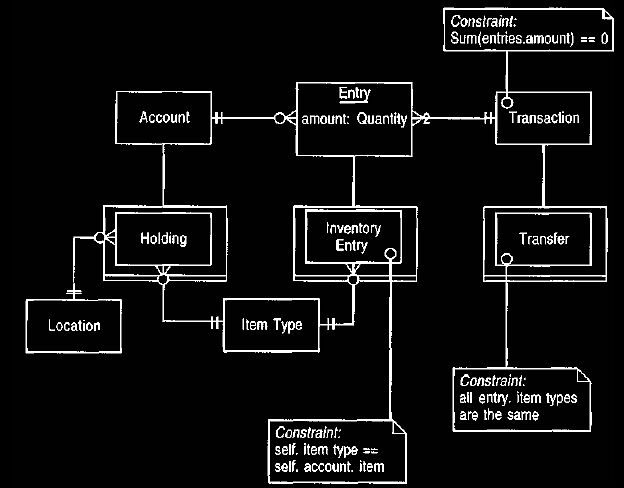

We have provided several examples to show that this model can be used as a basis

for both financial accounting and inventory tracking. With the accounting models

it is usual to sub-type to provide the information for the particular domain. For

example, consider inventory management—a problem suited to the use of

accounts. We can form an account for each combination of kind of goods and

location (and give it a less accounting name, such as holding).

Thus if we are tracking bottles of Macallans, Talisker, and Laphroig whiskey

between London, Paris, and Amsterdam we would have nine holdings (asset

accounts, such as London-Macallans, London-Talisker, Paris-Talisker, and so on).

Whenever we move goods from one location to another, we create a transfer

(transaction) to handle the movement. As with money, transfers have to balance.

In addition, the kind of object must be the same throughout the movement.

Figure 30 shows this kind of extension to the account model.

Figure 30. Specializing the account model to support inventories.

This kind of specialization should be done to use the accounting model in a

particular

domain.

This approach could also work to track orders, both incoming and outgoing.

Each supplier would have an income account, perhaps more than one if supplier

location was important. Similarly each customer would get an expense account.

We can track orders in two ways: We could allow sub-types of transfer, either

ordered or actual, or we could provide another set of holdings for orders, so we

would have, for example, London-Talisker-Ordered and London-Talisker-Actual.

When an order is placed, we would make a transfer

from a supplier ordered holding to the ordered holding at the location we want

it

delivered.

When the order is delivered, we would make the transfer between the

ordered holding and the actual holding at our location. This is exactly the same

as using a receivables account in financial books.

We can use summary holdings to get an overall picture. A summary holding

of all ordered holdings can give the total ordered position, and a summary

holding of Talisker gives the total amount of Talisker in all locations.

15. Booking Entries to Multiple Accounts

A common problem in dealing with accounts is when there is more than one place

to book an entry. For example, suppose we paid $500 for our airline ticket

to

attend

the OOPSLA conference. Do we book this to an OOPSLA account (so that we can

work out how much it cost us to attend OOPSLA) or to an air travel

account (so

that we can work out how much we spent on air travel)? There are several ways to

handle this, which illustrate some useful points about using

accounts and also

illustrate more complex account structures than the simple account hierarchies

mentioned earlier.

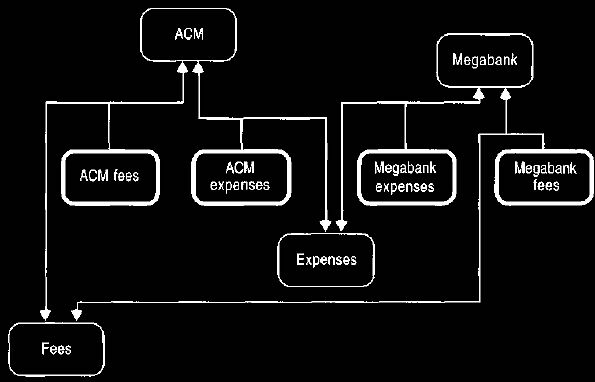

A typical consultant's bill illustrates the problem. Let's say that we do three

days' consultancy for ACM. We charge them $6000 for the work. In addition, we run

up some expenses: $500 for the air fare, $250 for the hotel, $150 for car

rental,

and $100 for meals. How do we account for this, or more precisely, how do we

account for this if we have a decent accounting system? Clearly we need an account

for ACM so that we can send them a bill. However, one account is not enough.

We are

interested in seeing how much we earn from various clients. When we do this

analysis, we do not want to see the expenses because they are not earned money.

Similarly our tax liability estimates also need to ignore expenses. This indicates that

we

could

use separate accounts for ACM fees and ACM expenses.

Our ACM bill is then

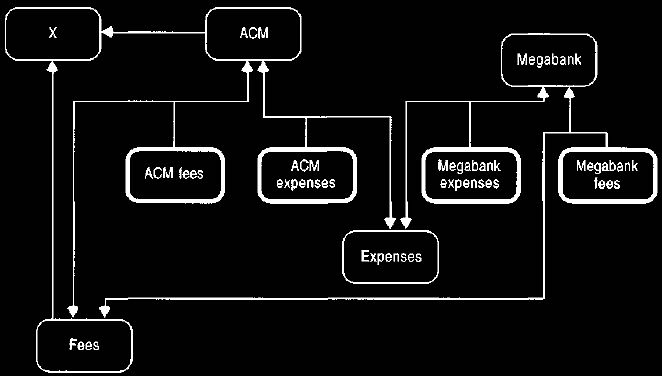

formed by a summary account over these two accounts, as shown in Figure 31.

The problem with this is that we need a separate account for all earned fees.

This

fee account would include accounts for ACM fees, Megabank fees, and

other clients' fees. This also works as a summary account, but it breaks the hierarchical

restriction of Figures 5 and 6. Thus we need to alter the model to allow a

detail

account to have multiple summary accounts as parents, as shown in Figure 32.

The model in Figure 32 allows the accounts to form a directed acyclic

graph. Thus an account can have many parents, but we avoid cycles (an account

cannot be its own grandparent). This structure allows multiple summary

accounts.

Figure 31. A typical fee/expense account structure.

The heavy bordered icons are detail accounts, summarized as shown by the arrows.

Figure 32. Allowing multiple summary accounts.

This diagram replaces the hierarchy of Figure 5 with a directed acyclic graph.

However, there is a small wrinkle that we must consider. What would occur if we had the account structure of

Figure 33? The account X sums over ACM and

fees, so the ACM fees account gets counted twice.

According to the model in Figure 32, we would still get a correct balance for X.

The balance is defined on a derived set of entries.

Figure 33. Account structure that highlights a problem.

If multiple summary accounts are used, someone could define a summary account

that has

overlapping detail accounts.

Sets do not

allow duplicates, so all the entries in ACM fees will only appear once in X,

thus

giving us a correct balance for X. However this balance will not be

equal to the

sums of the balances for fees and ACM, which might prove confusing. If this

confusion is a problem, we need a constraint on the components

relationship that

would not allow us to select components that had any overlap. This is a

reasonable

constraint since it is difficult to come up with an example

where such an

account

as X would be useful. Defining this kind of account is more likely to be the

product

of accident than design.

15.1 Using Memo Entries

The model works well at this level, but consider some further details. There may

be

a need to break down expenses in more detail. Tax regulations may

require us to

separate expenses for travel, lodging, and meals (for example, ACM-airfare,

ACM-lodging, Megabank-airfare, and so on). This could be done

by breaking each

expense account into detail accounts, but this could become difficult to manage

due to all the complex combination accounts.

It is worth exploring some other

options.

One option is to use entries into memo accounts. Thus $500 for a ticket to visit

ACM headquarters would result in depositing into both the ACM expenses

account and an airfare account. This method removes the need for

an ACM-airfare account but requires additional entries. A posting rule might

deal

with this to some extent, but we still need some statement about which expense

account is needed. This might be done by a special expense transaction creation

that takes parameters of from account, to account, and expense type memo

account.

Choosing whether the ACM expense account or the airfare account should be

a memo account depends on subsequent use of the account. If the ACM expense

account is being used to track the payment of invoices, while the airfare

account is

only being used for tax reporting, then the airfare account would make the

better

memo account. There's a certain amount of arbitrariness in choosing which

accounts hold the main stream of money, compared to those working with memo

accounts.

15.2 Derived Accounts

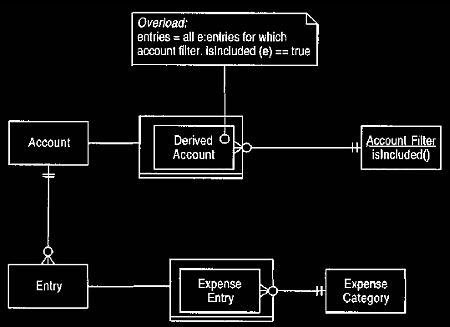

A different approach is to use a derived account, as in Figure 34. In this

case the

entries are specified by providing the derived account with a filter,

which selects matching entries. To work, the derived account needs

something on which to base its derivation. A sub-type of entry that supports an

expense category would do nicely, and then an account where the membership test

is expense category = airfare would create the desired information.

Figure 34. Introducing derived accounts.

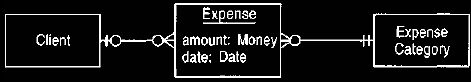

We might consider taking this approach further. Why not abandon using

accounts altogether and just have something like Figure 35? We can then work

out what is going on just by queries on expense.

Figure 35. Expenses defined to abandon the accounting model.

A derived account can still allow us to use all the reporting behavior, but we

lose the

tracking behavior.

This question helps define why accounts are useful and why derived accounts

are valuable. Accounts work best within relatively static structures where

complex movements of assets need to be tracked. If the movements are simple,

such as just assigning an expense to airfare, then accounts are not really

needed.

However, consider the situation where we visit both Megabank and ACM in one

trip and charge two-thirds of the airfare to one and one-third to the other.

This is

the kind of multi-legged transaction that accounts handle well. However, the

model in Figure 35 has a real problem with this. How do we split a simple

payment up in this way? Note that the model in Figure 35 has another problem:

It does not say where the money comes from. We could add a credit card

association

to it, but then expense looks very similar to a two-legged transaction.

Using attributes for derived accounts is effective when the account structure

is not very static. If there are many possible cuts of information, then the

derived

account allows these to be computed easily using the same reporting facilities

that accounts have. However, they only have the reporting facilities. Derived

accounts cannot be posted to and thus cannot be used to track the ebb and flow

of

assets.

So whenever we are trying to represent an aspect of an entry, we have a

choice between an attribute of the entry or a new account level. The decision is

based on what part of the account behavior you need. If it is simply the

reporting

side, we can use an attribute and derive an account when it's needed.

Otherwise,

a

new level of accounts is required.

Recommendations

We can recommend a couple of other sources for information on accounts that will

give a different perspective to that presented in this analysis.

Hay has a

section

dedicated to accounting. His basic concepts of accounts and transactions is very

much the same as ours, although he does not present

anything on posting rules.

He goes into much more depth on the account types that are present in

corporations. He also discusses the common transactions

that are used in

corporations and how they fit into this accounting model. He also presents a

knowledge level for these account and transaction types.

There has been a lot of work at the University of Illinois at Urbana-Champaign

on developing an accounting framework. This takes a

very different approach

to Hay and myself. It starts with treating the

information

on an invoice (for example) as a high-level "transaction" against a high-level

account.

This "transaction" can then be broken down to lower-level

"transactions"

against lower-level accounts. They use the word transaction very differently

than

we do: They do not follow the principle of conservation. A high-level

"transaction"

might be an invoice with all its line items. The framework concentrates on